AAA INT – Chapter 1: Regulatory environment

Key Points to Highlight in Chapter 1

Effective Regulatory Environment:

- Characteristics: Independence, transparency, accountability.

- Purpose: Ensure financial statement accuracy and integrity.

- Complexity: Not desirable as it hinders compliance and understanding.

International Standards on Auditing (ISAs):

- Set by the International Auditing and Assurance Standards Board (IAASB).

- Provide guidelines for auditors globally.

Role of Regulatory Bodies:

- Ensure financial statement accuracy.

- Uphold integrity and reliability in auditing.

External Regulatory Bodies:

- Example: Public Company Accounting Oversight Board (PCAOB).

- Oversees audits of public companies to protect investors’ interests.

International Federation of Accountants (IFAC):

- Promotes ethical conduct within the profession globally.

- Does not directly set auditing standards or enforce regulations.

Principle-Based Regulatory Framework:

- Examples: ISAs, PCAOB principles, IFRS.

- Provide broad guidelines for application.

Stringent Regulatory Requirements:

- Public company audits face the most stringent requirements.

- Higher stakes involved, including investor protection.

Challenges in the Digital Age:

- Increased risk of cybersecurity threats.

- Auditors must adapt approaches to address these risks effectively.

Ethical Framework in Auditing:

- Characteristics: Integrity, objectivity, confidentiality.

- Avoidance of aggressiveness to prevent unethical behavior.

Objective of Audit Regulation:

- Enhance financial reporting reliability.

- Ensure auditors follow standardized procedures and maintain independence.

Primary Stakeholders:

- Shareholders, auditors, regulators.

- Competitors are not primary stakeholders.

Role of Securities and Exchange Commission (SEC):

- Regulates public company audits in the United States.

- Ensures compliance with auditing standards and financial reporting requirements.

Benefits of Strong Regulatory Environment:

- Increased investor confidence.

- Enhanced audit quality.

- Improved financial reporting reliability.

International Ethics Standards Board for Accountants (IESBA):

- Sets ethical standards for professional accountants globally.

- Aims to promote ethical behavior and maintain public trust.

Internal Regulatory Bodies:

- Example: Institute of Internal Auditors (IIA).

- Focuses on setting standards for internal auditing.

Primary Objective of IAASB:

- Issuing auditing and assurance standards globally.

- Ensures consistency and reliability in audit practices.

Consequences of Weak Regulatory Oversight:

- Decline in audit quality.

- Higher risk of financial fraud.

- Loss of public trust.

Impact on Audit Fees:

- Stringent regulatory environment can increase audit fees.

- Auditors allocate more resources to comply with regulations.

Key Component of Regulatory Framework:

- Flexibility: Allows adaptation to changing business environments and emerging risks.

Objective of Audit Regulation:

- Enhance financial reporting reliability.

- Ensure accurate and trustworthy financial statements.

ACCA Advanced Audit & Assurance (AAA): Regulatory Environment

This chapter delves into the critical frameworks, regulations, and ethical considerations surrounding audit and assurance services. It equips you with the knowledge to navigate the complex regulatory landscape and perform your duties effectively.

Topic 1: International Regulatory Frameworks for Audit and Assurance Services

(a) Need for Laws, Regulations, Standards, and Guidance:

The financial world thrives on trust and transparency. To ensure these elements, a robust regulatory framework is essential. Laws, regulations, and professional standards govern audit and assurance practices, safeguarding the integrity of financial reporting.

- Laws: Establish the legal framework for conducting audits and set minimum requirements for auditors. Examples include company law and auditing standards legislation.

- Regulations: Provide detailed operational guidance for implementing the laws. Regulatory bodies like audit oversight boards may issue regulations.

- Standards: Developed by professional accounting bodies like ACCA, these detailed pronouncements prescribe the audit process and procedures auditors must follow.

(b) Legal and Professional Framework:

- Public Oversight:

- Public oversight bodies (POBs) like audit oversight boards ensure the quality and independence of audits.

- They establish auditing standards, investigate complaints against auditors, and promote best practices.

- Public confidence in the audit profession is strengthened by POBs.

- Corporate Governance Principles: Corporate governance principles guide how companies are directed and managed. These principles emphasize transparency, accountability, and risk management, ultimately impacting audit practices.

- Impact on Audit:

- Increased focus on risk assessment procedures.

- Enhanced communication between auditors and the audit committee.

- Greater emphasis on internal controls and corporate social responsibility.

- Impact on Audit:

(c) Role of the Audit Committee:

The audit committee is a critical sub-committee of the board of directors responsible for overseeing the integrity of financial reporting.

- Relationship with External Auditor:

- Appointment, Removal, and Monitoring: The audit committee plays a key role in selecting, appointing, and (if necessary) removing the external auditor. They also monitor the effectiveness of the audit engagement.

- Communication: The committee fosters open communication with the auditor, allowing for frank discussions on financial reporting issues and concerns.

- Oversight of Non-Audit Services: To prevent conflicts of interest, the audit committee often approves the provision of non-audit services (e.g., tax consulting) by the external auditor.

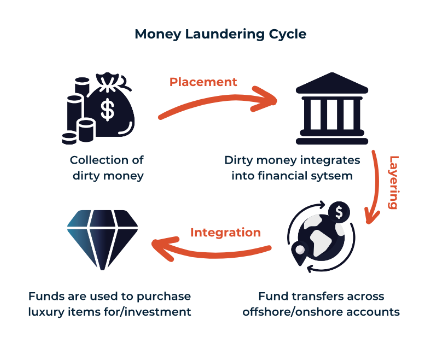

Topic 2: Money Laundering

(a) Definition and Methods:

- Money laundering is the process of concealing the illicit origin of funds derived from criminal activities (e.g., drug trafficking, fraud) and integrating them into the legitimate financial system.

International methods to combat money laundering include:

- Regulation: Laws and regulations establish reporting requirements for suspicious activity to financial intelligence units (FIUs).

- Customer Due Diligence (CDD)/Know Your Customer (KYC): Financial institutions must verify the identity of their clients and understand their business activities to identify potential money laundering risks.

- International cooperation: Information sharing and coordinated action between countries are crucial in tackling money laundering effectively.

(b) Scope of Offences and Professional Protection:

- Money laundering is a criminal offense with severe penalties.

- Professional accountants may be held liable (criminally or civilly) if they fail to report suspicious activity or knowingly facilitate money laundering.

(c) Need for Ethical Guidance:

Professional accounting bodies provide ethical guidance to help accountants navigate the complexities of money laundering. This guidance emphasizes professional skepticism and the importance of reporting suspicious activity.

(d) Accountants’ Obligations:

- Record Keeping: Accountants must maintain records of client identification and transactions for a prescribed period.

- Suspicious Activity Reporting (SAR): If accountants suspect money laundering, they have a legal and ethical obligation to report such activity to the appropriate regulatory body (FIU).

(e) Customer Due Diligence (CDD)/KYC:

- CDD/KYC helps identify and mitigate money laundering risks. It involves:

- Client Identification: Verifying identity through official documents (passport, ID card).

- Understanding the Client’s Business: Assessing the nature and purpose of the client’s business activities and identifying potential red flags.

- Ongoing Monitoring: Continuing to monitor client activity for suspicious transactions.

(f) Recognizing Suspicious Transactions:

- Red flags include:

- Clients with no apparent legitimate source of income.

- Complex or unusual transactions with no clear economic justification.

- Large cash transactions.

- Clients in high-risk industries (e.g., gambling).

- Recognizing red flags requires professional judgment and an awareness of money laundering typologies.

(g) Anti-Money Laundering (AML) Program:

Basic elements of an AML program include:

- Management commitment: Senior management must demonstrate a clear commitment to preventing money laundering by implementing and enforcing the AML program.

- Risk assessment: The program should assess the institution’s money laundering risks based on factors like client base, geographical location, and product offerings.

- Customer due diligence (CDD): As discussed earlier, CDD procedures are essential for identifying and verifying client identities and understanding their business activities.

- Suspicious activity monitoring: Systems and procedures should be in place to monitor transactions for suspicious activity and identify red flags.

- Training: Employees must be adequately trained on their AML obligations and how to identify and report suspicious activity.

- Reporting: Procedures should be established for reporting suspicious activity to the FIU as required by law.

Topic 3: Laws and Regulations

(a) Responsibilities of Management and Auditors:

- Management: Ultimately responsible for ensuring the company complies with all applicable laws and regulations. This includes establishing and maintaining internal controls to prevent and detect non-compliance.

- Auditors:

Responsible for expressing an opinion on whether the financial statements are prepared in accordance with the applicable financial reporting framework. This includes considering the potential impact of non-compliance on the financial statements.

(b) Auditors’ Considerations of Compliance:

- Risk Assessment: Auditors assess the risk of material misstatement due to non-compliance with laws and regulations. This involves considering the nature of the company’s business, the industry it operates in, and the regulatory environment.

- Audit Procedures:

Based on the risk assessment, auditors design and perform specific audit procedures to obtain evidence about the company’s compliance with laws and regulations. These procedures may involve:

- Inquiry of management.

- Reviewing relevant laws and regulations.

- Testing internal controls related to compliance.

(c) Reporting Non-Compliance:

- If auditors identify potential non-compliance, they should communicate it to appropriate levels of management, including the audit committee.

- Depending on the severity of the non-compliance, auditors may be required to report it in their audit report or to regulatory authorities.

(d) Withdrawal from Engagement:

- In extreme circumstances, auditors may need to withdraw from an audit engagement if:

- Management refuses to address a material non-compliance.

- There are significant limitations on the scope of the audit that prevent the auditor from obtaining sufficient audit evidence.

- The relationship between the auditor and management has broken down irretrievably.

By understanding the regulatory environment and fulfilling their obligations related to money laundering and compliance, auditors can play a vital role in safeguarding the integrity of financial reporting and promoting public trust in the financial system.