AFM – Chapter 1: Role of the senior financial adviser in the multinational organization

Role of the senior financial adviser in the multinational organization

Key Points to Highlight in Chapter 1

Senior Financial Adviser Responsibilities:

- Currency risk management

- Financial reporting compliance

- Capital budgeting decisions

- Marketing strategy development (not typically)

Capital Budgeting in Multinational Organizations:

- Considers both domestic and foreign market conditions.

Currency Risk Management Techniques:

- Hedging: Commonly used to manage currency risk.

Financial Reporting Compliance Objective:

- Ensures transparency and accountability to stakeholders.

Evaluation of Foreign Investment Opportunities:

- Considers political stability, domestic market share, cultural differences.

Financial Instruments for Capital Raising:

- Commercial paper, treasury bills, corporate bonds.

Role of Senior Financial Adviser:

- Identifying cost reduction opportunities crucial.

Foreign Exchange Exposure Evaluation:

- Includes transaction, economic, and translation exposure.

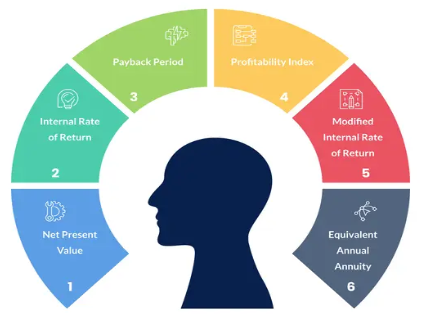

Capital Budgeting Analysis Techniques:

- Risk-adjusted Discount Rate (RADR) for projects with different risk profiles.

Transfer Pricing in Multinational Organizations:

- Involves setting prices for inter-divisional transactions.

Centralizing Treasury Operations Benefits:

- Improved liquidity management, risk management, operational efficiency.

Senior Financial Adviser Role:

- Monitors financial performance, analyzes data, provides guidance.

Factors in Optimal Capital Structure:

- Cost of capital, business risk, tax implications (not market share).

Mitigation of Political Risk:

- Strategies include diversification, hedging, outsourcing.

Evaluation of Foreign Direct Investment Opportunities:

- Considers exchange rate fluctuations, domestic interest rates, inflation rates.

Repatriation of Profits Techniques:

- Foreign exchange swaps, transfer pricing adjustments, offshore banking.

Currency Risk Management Goal:

- Minimizes impact of currency fluctuations on financial performance.

Assessing Credit Risk of Foreign Customers:

- Factors include economic conditions, political stability, payment history (not market share).

Performance Evaluation of Foreign Subsidiaries:

- Return on Investment (ROI) commonly used metric.

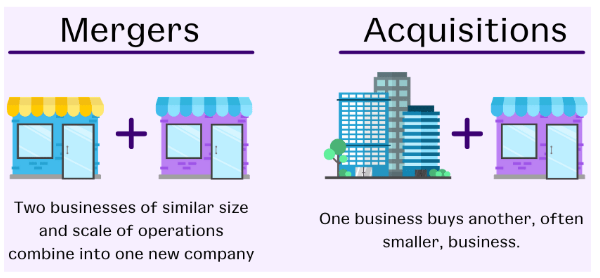

Financial Due Diligence in M&A:

- Assesses financial health and performance of target company.

Topic 1: The Role and Responsibility of Senior Financial Executive/Advisor

A) Developing Strategies for Organizational Goals

The senior financial advisor plays a crucial role in translating organizational goals into actionable financial strategies. This involves:

- Strategic Financial Planning:

Developing long-term financial plans aligned with the organization’s mission, vision, and strategic objectives. This may involve techniques like scenario planning and financial modeling.

- Capital Budgeting:

Evaluating and selecting capital investment projects that contribute to achieving strategic goals. Discounted Cash Flow (DCF) techniques like Net Present Value (NPV) and Internal Rate of Return (IRR) are often used for this purpose.

- Mergers and Acquisitions (M&A) Strategy:

Advising on potential M&A opportunities that align with the strategic goals and enhance the organization’s competitive advantage.

Illustration: A multinational pharmaceutical company aims to expand its market share in emerging economies. The financial advisor develops a financial plan focused on research and development (R&D) for new drugs relevant to those markets, and evaluates potential acquisitions of local pharmaceutical companies to gain market access.

B) Recommending Strategies for Efficient Financial Resource Management

The senior financial advisor ensures efficient utilization of financial resources through:

- Working Capital Management: Optimizing levels of inventory, receivables, and payables to minimize costs and maximize liquidity. Techniques like cash conversion cycle analysis are employed.

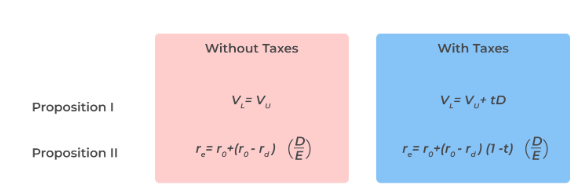

- Cost of Capital Management: Minimizing the overall cost of capital by employing a balanced mix of debt and equity financing. This involves considering factors like capital structure theories (Modigliani-Miller) and financial risk.

- Investment Appraisal Techniques: Evaluating potential investments using techniques like Net Present Value (NPV) to ensure they create shareholder value.

Illustration: A multinational clothing retailer implements stricter credit control procedures based on the advisor’s recommendations, leading to reduced bad debt and improved cash flow.

C) Advising on Financial Goals, Policies, and Communication

The senior financial advisor acts as a strategic partner to the board and management by:

- Setting Financial Goals: Recommending realistic and achievable financial goals based on the organization’s risk tolerance and industry benchmarks.

- Developing Financial Policies: Formulating policies for dividend payout, capital allocation, and risk management, considering theories like dividend irrelevance and signaling.

- Communicating Financial Information: Effectively communicating financial information to internal and external stakeholders, ensuring transparency and accountability.

Illustration: The financial advisor develops a dividend policy for the MNO that balances shareholder return with reinvestment needs, considering theories like Walter’s model and signaling effect.

Topic 2: Financial Strategy Formulation

A) Assessing Organizational Performance

Financial advisors use various methods to assess organizational performance:

- Ratio Analysis: Analyzing financial ratios like profitability ratios (return on equity – ROE), liquidity ratios (current ratio), and solvency ratios (debt-to-equity ratio) to identify strengths and weaknesses.

- Trend Analysis:

Examining trends in key financial metrics over time to identify patterns and potential areas for improvement.

Illustration: The advisor identifies a declining return on equity (ROE) trend, prompting a review of operational efficiency and cost-cutting measures.

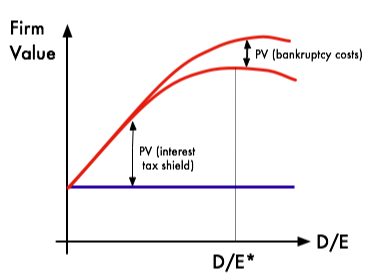

B) Capital Mix and Structure

The advisor recommends an optimal capital structure, considering:

- Modigliani-Miller (MM) Theories:

MM Theorem I suggests that in a perfect market, capital structure is irrelevant to firm value. However, MM Theorem II acknowledges the impact of corporate taxes, leading to a target capital structure that balances cost of capital and tax benefits.

- Trade-off Theory:

This theory suggests a trade-off between debt financing (financial risk) and equity financing (agency costs). The advisor aims to find a balance that minimizes the overall cost of capital.

Illustration: The advisor recommends increasing the debt-to-equity ratio to a moderate level based on the company’s risk tolerance and tax benefits, considering MM theories and the trade-off theory.

C) Distribution and Retention Policy

The advisor recommends a dividend policy that considers:

- Dividend Irrelevance Theory: This theory suggests that dividend policy has no impact on firm value in a perfect market. However, in practice, dividend payouts can signal management’s confidence in future prospects.

- Walter’s Model: This model suggests a target payout ratio based on a company’s growth opportunities and reinvestment needs.

D) Theoretical and Practical Rationale for Risk Management

- Risk Management Theories:

- Value at Risk (VaR): This technique estimates the maximum potential loss over a specific period at a given confidence level.

- Modern Portfolio Theory (MPT): This theory suggests that investors can achieve optimal portfolios by diversifying across asset classes to reduce risk without sacrificing return.

- Practical Applications:

- Implementing risk mitigation strategies like hedging foreign exchange exposure to minimize currency fluctuations.

- Establishing risk management frameworks that identify, assess, and prioritize risks, along with mitigation plans.

Illustration: The advisor recommends hedging a portion of the MNO’s foreign currency receivables to mitigate potential losses due to adverse exchange rate movements.

E) Assessing Business and Financial Risk

The advisor assesses various risks that can impact the MNO:

- Business Risks: Operational risks (disruptions, inefficiencies), reputational risks (product recalls, scandals), and political risks (government instability) can affect profitability.

- Financial Risks:

Market risks (fluctuations in interest rates, exchange rates, or stock prices), credit risks (debt defaults), and liquidity risks (inability to meet short-term obligations) can impact financial stability.

Illustration: The advisor identifies the MNO’s overreliance on a single supplier in a politically unstable country as a potential supply chain disruption risk.

F) Risk Management Framework

The advisor helps develop a framework for managing risk:

- Risk Identification: Identifying all potential risks that the MNO might face.

- Risk Assessment: Evaluating the likelihood and potential impact of each risk.

- Risk Mitigation: Developing strategies to reduce the likelihood or impact of risks, such as diversification, hedging, or insurance.

- Risk Monitoring: Continuously monitoring risks and updating the risk management framework as needed.

G) Capital Investment Monitoring

The advisor establishes systems to monitor capital investments and manage related risks:

- Project Performance Monitoring: Tracking project progress against budget and schedule to identify deviations early on.

- Post-Completion Review: Evaluating the actual performance of completed projects compared to initial projections.

- Risk Management for Capital Projects: Identifying and mitigating risks associated with capital projects, such as cost overruns or project delays.

H) Impact of Behavioral Finance

Behavioral finance recognizes that investors and financial decision-makers are not always perfectly rational. This can lead to:

- Overconfidence Bias: Investors overestimate their ability to pick winning investments, leading to excessive risk-taking.

- Herding Behavior: Investors mimic the actions of others, potentially leading to bubbles or crashes.

- Loss Aversion: Investors are more sensitive to potential losses than gains, impacting investment decisions.

The advisor considers these biases when formulating financial strategies and developing communication plans for stakeholders.

Topic 3: Corporate Environmental, Social, Governance (ESG) and Ethical Issues

A) Assessing ESG Commitment

The advisor evaluates the MNO’s commitment to ESG factors by:

- Reviewing ESG Policies: Assessing the MNO’s policies on environmental sustainability, social responsibility, and corporate governance.

- Analyzing ESG Performance: Evaluating the MNO’s track record in areas like waste management, employee well-being, and board diversity.

- Identifying Potential Conflicts: Identifying potential conflicts between ESG goals, such as balancing environmental sustainability with cost reduction initiatives.

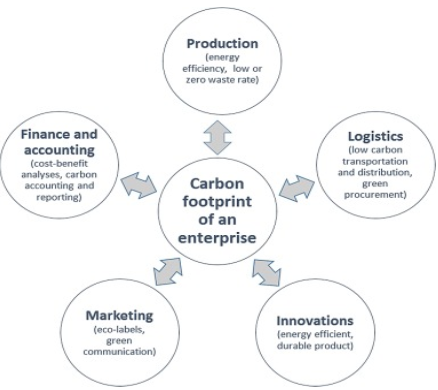

B) Impact on Physical Environment

The advisor considers the environmental impact of the MNO’s operations and investments:

- Carbon Footprint Analysis:

Estimating the MNO’s greenhouse gas emissions and exploring ways to reduce them.

- Sustainable Resource Management: Recommending strategies for sustainable use of natural resources throughout the supply chain.

Illustration: The advisor recommends investing in renewable energy sources to reduce the MNO’s carbon footprint and enhance its environmental sustainability.

C) Stakeholder Management

The advisor helps the MNO effectively manage its relationships with stakeholders:

- Stakeholder Identification: Identifying all groups impacted by the MNO’s decisions, such as employees, customers, communities, and investors.

- Stakeholder Engagement: Developing strategies to communicate with stakeholders and address their concerns.

D) Impact on Stakeholders

The advisor assesses the impact of financial strategies on stakeholders:

- Employee Relations: Considering the impact of financial decisions on employee wages, benefits, and job security.

- Community Impact: Evaluating the potential impact of the MNO’s operations on local communities.

- e) Agency Issues and Stakeholder Conflicts

The advisor identifies potential conflicts arising from:

- Agency Issues: Conflicts between the interests of management (agents) and shareholders (principals). This can involve empire building or excessive risk-taking by management.

- Stakeholder Conflicts: Conflicts between the interests of different stakeholder groups. For example, shareholders may prioritize short-term profits, while employees may prioritize job security.

Strategies for Dealing with Conflicts:

- Alignment of Interests: Developing structures and incentives that align the interests of management with those of shareholders and other stakeholders.

- Transparency and Disclosure: Ensuring transparency in decision-making and financial reporting to build trust with stakeholders.

- Stakeholder Engagement: Proactive communication and engagement with stakeholders to address their concerns and find mutually beneficial solutions.

Illustration: The advisor recommends establishing a stakeholder advisory council to promote open communication and address potential conflicts between stakeholder groups.

F) Resolving Stakeholder Conflict

The advisor helps resolve stakeholder conflicts through:

- Facilitation: Acting as a neutral facilitator to bring stakeholders together to discuss their concerns and find common ground.

- Negotiation: Assisting in negotiation processes to reach mutually agreeable solutions.

- Developing Compromise Solutions: Developing solutions that address the key concerns of each stakeholder group as much as possible.

G) Impact of Ethical and Governance Issues

Ethical and governance issues can have a significant financial impact on the MNO:

- Reputational Damage: Unethical business practices can damage the MNO’s reputation, leading to lost sales, customer boycotts, and regulatory fines.

- Increased Costs: Compliance failures and legal issues can lead to significant financial costs.

H) Ethical and Governance Framework

The advisor recommends an ethical and governance framework that includes:

- Code of Conduct: A code of conduct that outlines the MNO’s ethical standards and expectations for employee behavior.

- Corporate Governance Policies: Policies on board composition, executive compensation, and risk management.

- Whistleblower Protection: Mechanisms for employees to report unethical behavior without fear of retaliation.

Topic 4: Management of International Trade and Finance

A) Free Trade and Trade Barriers

The advisor:

- Advocates for Free Trade: Free trade agreements eliminate or reduce tariffs and other trade barriers, promoting international trade and economic growth.

- Advises on Trade Barriers: Identifies and advises on mitigating the impact of trade barriers such as tariffs, quotas, and subsidies.

Illustration: The advisor analyzes the potential impact of a new free trade agreement on the MNO’s import and export costs.

B) Major Trade Agreements and Common Markets

The advisor keeps the MNO informed about the implications of:

- Regional Trade Agreements (RTAs):

- NAFTA

Agreements between groups of countries like NAFTA or the EU, which can create new market opportunities or competitive challenges.

- EU

- Common Markets: Economic unions like the EU with free movement of goods, services, capital, and labor, requiring strategic planning for the MNO.

C) Actions of International Financial Institutions

The advisor explains how actions by institutions like:

- World Trade Organization (WTO): Sets the rules for international trade and adjudicates trade disputes.

- International Monetary Fund (IMF):

Provides financial assistance to countries facing economic difficulties and promotes international monetary cooperation.

- World Bank:

Provides loans and technical assistance to developing countries for infrastructure development and poverty reduction.

- Central Banks:

Set monetary policy to influence inflation, interest rates, and economic growth, impacting the MNO’s borrowing costs and foreign exchange exposure.

D) Role of International Financial Institutions

The advisor explains the role of international financial institutions in:

- Global Debt Management: The IMF and World Bank assist countries in managing their debt burden and promoting sustainable economic growth.

- Financial Development of Emerging Economies: These institutions provide financial support and technical assistance to help developing countries build their financial systems and attract foreign investment.

- Global Financial Stability: International cooperation through these institutions helps to maintain global financial stability and prevent financial crises.

E) Latest Developments in World Financial Markets

The advisor keeps the MNO updated on:

- Causes and Impact of Financial Crises: Analyzing the causes of past financial crises and advising on how to mitigate future risks.

- Dark Pool Trading:

Explaining the implications of alternative trading systems like dark pools, where buy and sell orders are not publicly displayed, on the MNO’s trading strategies.

- Removal of Barriers to Capital Movement: Advising on the potential impact of increased capital flows on the MNO’s ability to raise capital and invest in different countries.

- International Money Laundering Regulations: Ensuring the MNO complies with regulations designed to prevent money laundering and terrorist financing.

F) New Developments in the Macroeconomic Environment

The advisor:

- Monitors Macroeconomic Trends: Analyzes trends in global economic growth, inflation, and interest rates.

- Assesses Impact on the MNO: Evaluates the potential impact of these trends on the MNO’s operations, such as changes in demand for its products, input costs, and foreign exchange exposure.

- Recommends Responses: Recommends strategies to mitigate risks and capitalize on opportunities arising from macroeconomic developments.

Illustration: The advisor anticipates a slowdown in global economic growth and recommends cost-cutting measures and exploring new markets in less-affected regions to maintain profitability.

Topic 5: Strategic Business and Financial Planning for Multinationals

A) Financial Planning Framework for MNOs

The advisor develops a financial planning framework that considers:

- National Regulatory Requirements: Compliance with listing requirements on stock exchanges like the London Stock Exchange (LSE) regarding financial reporting and corporate governance.

- Capital Mobility: Strategies for managing the cross-border movement of capital, considering factors like foreign exchange exposure and repatriation restrictions.

- Economic and Risk Exposures: Assessing the economic and risk landscape in different national markets, including political risks, currency fluctuations, and infrastructure challenges.

- Agency Issues: Balancing central control with local financial autonomy for overseas subsidiaries to address agency problems arising from information asymmetry and potential for self-interest.

Illustration: The advisor recommends establishing regional treasury centers to manage foreign exchange exposure and optimize cash flow across the MNO’s global operations.

Topic 6: Dividend Policy in Multinationals and Transfer Pricing

A) Determining Dividend Capacity

The advisor considers several factors to determine dividend capacity:

- Short- and Long-Term Reinvestment Needs: Balancing dividend payouts with the need to reinvest in research and development, capital expenditures, and expansion plans.

- Capital Reconstructions: The impact of share repurchases and new share issuances on free cash flow available for dividends.

- Central Remittances: Availability of funds from overseas subsidiaries for distribution as dividends, considering repatriation restrictions and tax implications.

- Corporate Tax Regime: Tax implications of dividend payouts in different countries, exploring strategies like tax havens or double taxation treaties.

- Transfer Pricing Policy: Ensuring transfer pricing policies between subsidiaries comply with arm’s length principle to avoid tax liabilities and maintain accurate financial reporting.

B) Dividend Capacity and Capital Investment Programs

The advisor helps assess the impact of capital investment programs on dividend capacity:

- Project Cash Flow Analysis: Evaluating the projected cash flows from capital investment projects to determine their impact on available funds for dividend payouts.

- Sustainable Dividend Policy: Recommending a sustainable dividend policy that balances shareholder return with the need to reinvest in the MNO’s long-term growth.

This in-depth content provides a comprehensive overview of the senior financial advisor’s role in a multinational organization. By understanding these responsibilities and the relevant theories, financial advisors can effectively contribute to the strategic financial management of MNOs in today’s complex global business environment.