AFM – Chapter 2: Advanced investment appraisal

Advanced investment appraisal

Key Points to Highlight in Chapter 2

Net Present Value (NPV) Method:

- Considers time value of money.

- Discount rate used to calculate present value of future cash flows.

- Provides accurate assessment of investment profitability.

Internal Rate of Return (IRR):

- Discount rate where NPV equals zero.

- Indicates investment’s rate of return.

Payback Period Method:

- Time required to recover initial investment.

- Shorter payback period preferred.

Accounting Rate of Return (ARR):

- Focuses on accounting profits.

- Ignores time value of money.

Limitations of Payback Period Method:

- Ignores cash flows after payback period.

- Fails to consider time value of money.

- Subjective determination of required payback period.

Discounting Future Cash Flows:

- NPV method discounts at cost of capital.

Profitability Index (PI):

- Ratio of present value of cash inflows to initial investment.

- PI > 1 indicates profitable investment.

IRR and Reinvestment Assumption:

- Assumes reinvestment of cash flows at cost of capital.

Drawbacks of Accounting Rate of Return (ARR):

- Ignores time value of money.

- Subjective determination of required payback period.

- Ignores cash flows beyond payback period.

Choosing Projects with NPV Method:

- Project with highest NPV preferred.

Disadvantage of Profitability Index (PI):

- Does not consider total profitability of investment.

Sensitivity Analysis:

- Assesses impact of changes in key variables on NPV.

Scenario Analysis:

- Considers factors like political risk, economic conditions, and market demand.

IRR for Projects with Unconventional Cash Flows:

- Suitable for projects with unconventional cash flow patterns.

Understanding Profitability Index (PI):

- PI > 1 indicates profitable investment.

Discount Rate for NPV Method:

- Cost of capital used as discount rate.

Payback Period Method:

- Easy to calculate and understand.

Payback Period vs. Discount Rate Sensitivity:

- Payback period less affected by changes in discount rate.

Comparing Projects of Different Sizes:

- Profitability Index (PI) used for comparison.

Choosing Projects with NPV Method:

- Project with highest NPV chosen.

Topic 1: Discounted Cash Flow Techniques

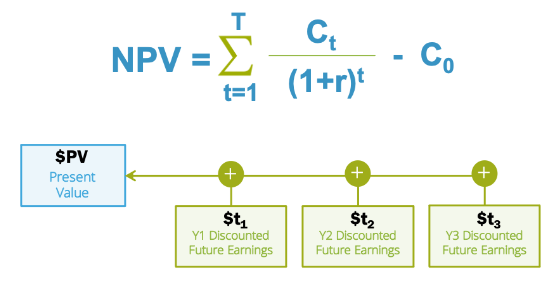

A) Net Present Value (NPV) Model

The NPV model is a widely used technique to evaluate the potential value added by an investment project. It considers the time value of money by discounting all future cash flows (both inflows and outflows) to their present value using a chosen discount rate (usually the cost of capital). A project with a positive NPV is considered value-adding, while a negative NPV indicates potential value destruction.

Project Modelling Considerations:

- Inflation and Specific Price Variation: Future cash flows should be adjusted for inflation or specific price changes affecting the project. This can be done using inflation indices or specific price forecasts.

- Taxation: Tax implications should be factored in. This includes considering tax-allowable depreciation, tax exhaustion allowances, and the impact of taxes on cash flows.

- Capital Rationing (Multi-period discussion): When resources are limited, capital rationing forces a choice between competing projects. NPV can be used to prioritize projects with the highest potential value creation.

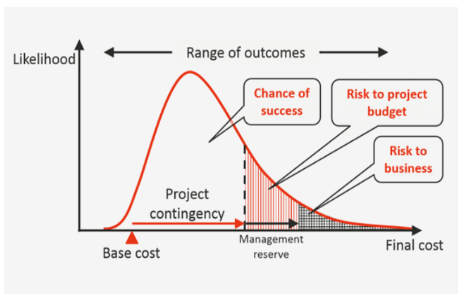

- Probability Analysis and Sensitivity Analysis: Investment decisions involve uncertainty. Sensitivity analysis explores how the NPV changes with variations in key assumptions (e.g., discount rate, sales volume). Probability analysis uses simulations to assess the likelihood of different NPV outcomes.

- Risk-Adjusted Discount Rates: A higher discount rate reflects a riskier project. The chosen discount rate should consider both the project’s specific risk and the organization’s overall cost of capital.

- Project Duration as a Measure of Risk: Longer-duration projects are generally considered riskier due to uncertainties extending over a longer period.

Illustration:

Company X is evaluating a new production line with an initial investment of $1 million. The project is expected to generate annual cash inflows of $250,000 for five years. The company’s cost of capital is 10%. Ignoring taxes and inflation, the NPV of the project is:

NPV = -Initial Investment + PV(Year 1 Cash Flow) + PV(Year 2 Cash Flow) + … + PV(Year 5 Cash Flow)

NPV = -$1,000,000 + ($250,000 / (1+0.10)^1) + … + ($250,000 / (1+0.10)^5)

NPV ≈ $683,013 (positive, indicating potential value creation)

B) Monte Carlo Simulation

Monte Carlo simulation is a technique that uses random sampling to assess the potential range of outcomes for an investment project. It allows for a more nuanced understanding of risk by simulating various scenarios and their associated probabilities.

Significance of Simulation Output:

- Likelihood of Project Success: The simulation can estimate the probability of achieving a positive NPV or exceeding a certain target return.

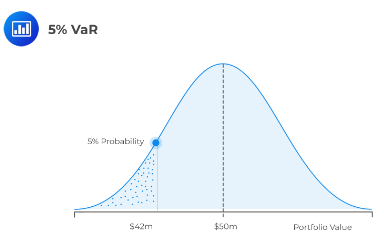

- Project Value at Risk (VaR):

VaR measures the potential maximum loss within a specific confidence level (e.g., 95%). This helps assess the downside risk of an investment.

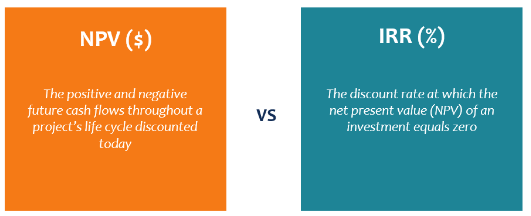

C) Internal Rate of Return (IRR) and Modified IRR

The IRR is the discount rate that makes the NPV of a project equal to zero. It represents the project’s expected compound annual growth rate (CAGR). However, IRR has limitations:

- Multiple IRRs can exist for projects with non-conventional cash flow patterns.

- IRR ignores the time value of money across the project’s life.

The Modified IRR (MIRR) addresses some of these limitations by considering the reinvestment rate for positive cash flows and the cost of capital for negative cash flows.

NPV vs. IRR:

- NPV is generally preferred due to its consideration of the time value of money and ease of comparison across projects of different sizes.

- IRR can be useful for understanding the project’s inherent profitability, but its limitations should be considered.

Illustration:

Using the same project data from the NPV example, the IRR might be calculated to be 15%. However, comparing an IRR of 15% from a short-term project with an IRR of 15% from a long-term project using NPV would be more reliable.

Topic 2: Application of Option Pricing Theory in Investment Decisions

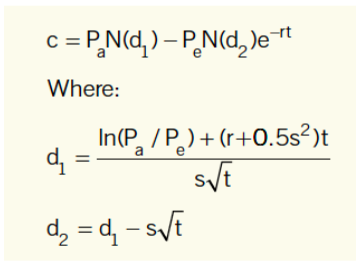

A) Black-Scholes Option Pricing (BSOP) Model

The BSOP model is a mathematical model used to value options. It considers five key factors:

- Value of the Underlying Asset: The higher the underlying asset’s price, the more valuable the option.

- Exercise Price (Strike Price): The higher the exercise price, the less valuable the option.

- Time to Expiry: The longer the time until expiry, the more valuable the option due to time value decay (increased chance of the underlying asset reaching a price profitable for exercising the option).

- Volatility: Higher volatility in the underlying asset price leads to a more valuable option (greater chance of significant price movements that could benefit the option holder).

- Risk-Free Rate: A higher risk-free rate reduces the option’s value because the present value of the exercise price becomes less attractive compared to risk-free investments.

Underlying Assumptions, Structure, Application, and Limitations of the BSOP Model:

- Assumptions: The BSOP model makes several assumptions, including:

- Continuous trading of the underlying asset.

- Constant volatility over the option’s life.

- No transaction costs or dividends.

- Log-normal distribution of the underlying asset price.

- Structure: The BSOP model is a complex mathematical formula that considers all the above factors to calculate the theoretical value of an option. Financial calculators and spreadsheet software often have built-in BSOP functions.

- Application: The BSOP model is used for valuing various options, including stock options, currency options, and commodity options. It helps investors make informed decisions about buying, selling, or exercising options.

- Limitations: Despite its widespread use, the BSOP model has limitations. The model’s accuracy depends on the validity of its assumptions, which may not always hold true in real-world markets.

B) Real Options within a Project

Real options are embedded options within a project that provide flexibility in decision-making throughout the project’s life. These options are not formal financial instruments but represent the inherent decision rights associated with the project. Common real option archetypes include:

- Option to Delay: The ability to postpone project initiation based on market conditions or technological advancements.

- Option to Expand: The right to increase the project’s scale if future demand proves higher than expected.

- Option to Redeploy: The flexibility to shift resources from the project to a more promising opportunity elsewhere.

- Option to Abandon: The right to terminate the project if it becomes unprofitable.

- c) Valuation of Options using BSOP Model

The BSOP model can be adapted to estimate the value of real options within a project. By adjusting the model’s parameters to reflect the specific project characteristics and the nature of the real option, we can assess the potential value associated with flexibility.

Illustration:

Company Y is considering a new product launch. There is uncertainty about market demand for the product. The BSOP model can be used to value the option to delay the launch if initial market response is weak. The model would consider factors like the product’s development stage, potential future demand forecasts, and the cost of delaying the launch.

Topic 3: Impact of Financing on Investment Decisions and Adjusted Present Values

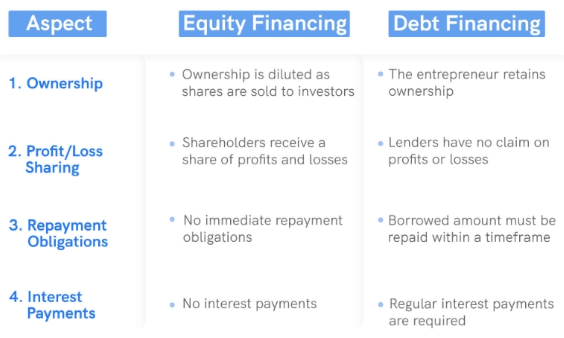

A) Financing Sources

Organizations can access various financing sources to fund their investments. The choice of financing method significantly impacts project value and the organization’s overall financial structure. Common financing sources include:

- Equity: Funds raised from issuing new shares.

- Debt: Borrowing funds from lenders, such as banks or through bond issuance.

- Hybrids: Securities combining features of debt and equity.

- Lease Finance: Off-balance sheet financing through equipment leasing.

- Venture Capital and Business Angel Finance: Investments in early-stage businesses.

- Private Equity: Investment funds acquiring mature companies.

- Asset Securitization and Sale: Selling financial assets backed by receivables or other assets.

- Islamic Finance: Sharia-compliant financing instruments.

- Security Token Offerings (STOs): Fundraising through blockchain-based tokens.

The choice of financing source should consider the organization’s financial position, risk tolerance, and the specific project requirements.

B) Islamic Finance

Islamic finance offers alternative financing methods that comply with Islamic principles. Some key features include:

- Profit-sharing: Sharing profits and losses between the financier and the project instead of fixed interest payments.

- Asset-based financing: Financing based on underlying assets rather than debt obligations.

- Risk sharing: Both parties share risks associated with the investment.

Islamic finance is a growing source of funding for organizations seeking Sharia-compliant options.

C) Green Finance

Green finance focuses on funding projects that benefit the environment and promote sustainability.

Organizations with an environmental/sustainable agenda can access green financing options, such as:

- Green bonds: Bonds issued to finance environmentally friendly projects.

- Green loans: Loans specifically designated for sustainable initiatives.

- Project finance: Financing structured for specific green projects.

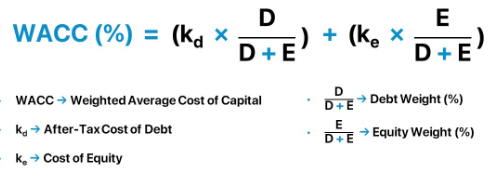

D) Cost of Capital

The cost of capital represents the minimum expected return that investors require for providing capital to an organization. It is a crucial factor in investment appraisal and reflects the risk associated with the financing sources used. There are two main components:

- Cost of Equity: The return expected by equity investors, typically measured using models like the Capital Asset Pricing Model (CAPM).

- Cost of Debt: The interest rate paid to lenders or the yield on issued debt instruments.

The weighted average cost of capital (WACC) combines the costs of equity and debt based on their proportions in the capital structure.

Appropriateness of Cost of Capital:

The cost of capital is a key discount rate used in project appraisal techniques like NPV. However, it’s important to consider its limitations:

- Static: The cost of capital is a point-in-time estimate and may not reflect future changes in risk or financing conditions.

- Subjectivity: Estimating the cost of equity, particularly for private companies, can involve subjective judgments.

Project-Specific Cost of Capital:

For certain high-risk projects, a project-specific cost of capital might be used. This considers the project’s unique risk profile and may be higher than the organization’s overall WACC.

Business and Financial Risk:

The cost of capital is closely linked to the organization’s business risk (inherent risk of the industry) and financial risk (risk associated with its capital structure). Higher risk typically leads to a higher cost of capital.

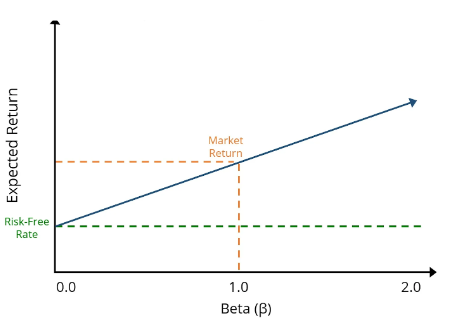

Capital Asset Pricing Model (CAPM):

CAPM is a common model used to estimate the cost of equity. It considers the risk-free rate, the market risk premium, and the project’s beta (a measure of its systematic risk relative to the market).

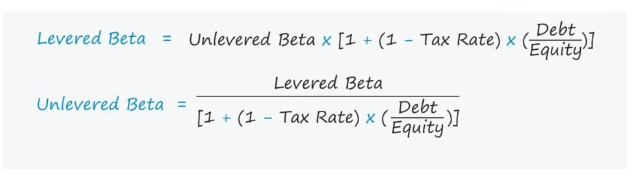

Equity and Asset Betas:

- Equity Beta (Levered): Measures the volatility of a company’s stock compared to the overall market.

- Asset Beta (Unlevered) : Measures the volatility of a project’s cash flows relative to the market.

E) Debt Exposure and Interest Rate Risk

Organizations with high debt levels are more exposed to interest rate changes. This can impact their profitability and financial stability.

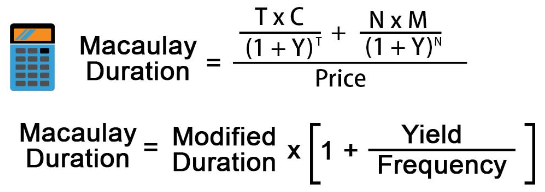

Duration Analysis:

- Simple Macaulay Duration: A measure of the average life of a debt instrument, considering the timing and amount of cash flows.

- Modified Duration: A more accurate measure that considers the non-linear relationship between interest rates and bond prices.

Benefits and Limitations of Duration:

- Benefits: Duration helps assess the sensitivity of a bond’s price to interest rate changes.

- Limitations: Duration is a single point estimate and doesn’t capture the entire relationship between interest rates and bond prices. Convexity, a measure of the curvature of a bond’s price-yield relationship, needs to be considered for a more complete picture.

F) Credit Risk

Credit risk is the risk that a borrower defaults on a loan. Organizations should assess their creditworthiness and the credit risk associated with potential lenders.

Credit Rating Agencies:

Rating agencies like Moody’s and Standard & Poor’s assess the creditworthiness of organizations and issue credit ratings. These ratings influence the interest rates offered by lenders.

Estimating Credit Spread:

The credit spread is the difference between the yield on a corporate bond and the yield on a risk-free government bond. Higher credit risk leads to a wider credit spread.

Cost of Debt Capital:

The cost of debt capital considers the risk-free rate and the credit spread.

G) Impact of Financing and Capital Structure

The financing choices made by an organization can significantly impact its value and risk profile. Key considerations include:

- Modigliani and Miller (M&M) Propositions: These propositions, with and without taxes, explore the theoretical irrelevance of capital structure to firm value in a perfect market. However, real-world market imperfections create financing trade-offs.

- Static Trade-Off Theory: This theory suggests a trade-off between the benefits of debt tax shields (tax savings from interest expense) and the costs of financial distress (potential bankruptcy costs) as debt levels increase.

- Pecking Order Theory: This theory suggests firms prefer internal financing (retained earnings) and then progress to debt before issuing new equity, due to information asymmetry and signaling effects.

- Agency Effects: Agency conflicts can arise between managers and shareholders.

- Agency Effects (continued): Debt financing can mitigate agency problems by aligning the interests of managers and shareholders (debt acts as a disciplining device). However, excessive debt can also lead to excessive risk-taking by managers.

H) Adjusted Present Value (APV) Technique

The APV technique is used to evaluate investments that significantly alter an organization’s capital structure. It considers the impact of financing choices on the project’s value.

Fiscal and Transaction Costs:

- Fiscal Costs: Tax implications of different financing options, such as the tax benefits of debt.

- Transaction Costs: Costs associated with arranging and issuing financing, such as underwriting fees for issuing new equity.

Illustration:

Company Z is considering a large expansion project. The project itself has a positive NPV based on its unlevered cash flows. However, the company needs to raise significant debt to finance the project. The APV technique would consider the tax benefits of debt financing (tax shield) but also factor in the transaction costs of issuing new debt. This would provide a more accurate assessment of the project’s value after considering the financing impact.

I) Impact of Capital Investment Projects on Financial Performance

Significant capital investment projects can affect an organization’s financial position and performance in several ways:

- Increased Asset Base: The project may lead to an increase in assets on the balance sheet, impacting financial ratios like the debt-to-equity ratio.

- Increased Cash Flow Generation: A successful project can generate additional cash flows, improving the organization’s liquidity and financial flexibility.

- Financing Costs: The financing used to fund the project will impact the organization’s interest expense and overall cost of capital.

- Profitability: The project’s impact on profitability depends on its operating margins and the financing costs incurred.

Alternative Financing Strategies:

The choice of financing strategy can significantly influence the project’s overall impact. Considerations include:

- Debt vs. Equity Financing:

Debt financing can offer tax benefits but increases financial risk. Equity financing dilutes existing shareholder ownership but avoids interest expenses.

- Hybrid Financing: Combining debt and equity can offer a balance between risk and return.

- Project Finance: This approach uses the project’s own cash flows to secure debt financing, reducing risk for the overall organization.

By carefully considering the financing options and their implications, organizations can maximize the value creation potential of capital investment projects.

Topic 4: Valuation and the Use of Free Cash Flows

A) Valuation Models

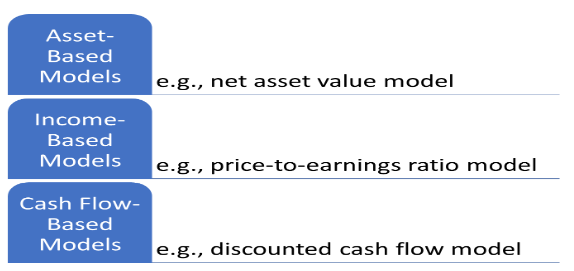

There are three main categories of valuation models:

- Asset-Based Models: These models value a company based on the value of its underlying assets (e.g., net asset value model).

- Income-Based Models: These models value a company based on its ability to generate future earnings (e.g., price-to-earnings ratio model).

- Cash Flow-Based Models: These models are considered the most reliable for valuing a company, as they focus on the cash flows the company is expected to generate over time (e.g., discounted cash flow model).

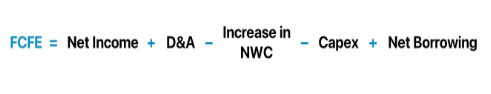

Free Cash Flow (FCF) and Free Cash Flow to Equity (FCFE):

- FCF: Represents the cash flow available to all investors after accounting for operating expenses and capital expenditures.

- FCFE: Represents the cash flow available to equity shareholders after accounting for operating expenses, capital expenditures, and interest expense.

Horizon and Growth Assumptions:

Valuation models require assumptions about the company’s future growth prospects and the appropriate discount rate. These assumptions significantly impact the final valuation.

B) Option Pricing Models for Valuation

Option pricing models, like the BSOP model, can be used to assess the value of equity, debt, and default risk.

- Equity Valuation: Equity can be viewed as a call option on the company’s assets, with the exercise price being the company’s debt obligations.

- Debt Valuation: Debt can be viewed as a put option on the company’s assets, giving the lender the right to seize assets if the company defaults.

- Default Risk: Option pricing models can be used to estimate the probability of default for a company’s debt, which influences its creditworthiness and valuation.

Illustration:

Company X is being valued using a discounted cash flow model based on its projected free cash flows. The model also considers the company’s capital structure and uses option pricing to account for the embedded options in its debt and equity. This provides a more comprehensive valuation compared to simpler models.

Topic 5: International Investment and Financing Decisions

A) Impact of Exchange Rates

Exchange rate fluctuations can significantly impact the value of a project, particularly for international investments. A project’s cash flows are denominated in a specific currency, but the organization might value them in its home currency. Changes in exchange rates can translate foreign currency cash flows into gains or losses upon conversion to the home currency.

B) Project/Company Cash Flow Forecasting and NPV

When evaluating international projects, it’s crucial to forecast cash flows in the relevant foreign currency. The NPV can then be calculated using either the foreign currency cash flows discounted by a foreign currency discount rate or the converted cash flows discounted by the organization’s home currency discount rate (considering exchange rate expectations).

C) Exchange Controls and Restricted Remittance

Some countries may impose exchange controls, restricting the movement of capital in and out of the country. This can affect the ability of an organization to repatriate profits from an international investment. Strategies for dealing with restricted remittance include:

- Reinvestment: Reinvesting profits back into the foreign operation.

- Lead and Lag: Managing foreign currency exposures through timing of payments and receipts.

- Transfer Pricing: Setting prices for transactions between the parent company and its foreign subsidiaries to optimize cash flow movement.

D) International Financing Sources

Organizations can access various financing sources for international investments:

- International Equity Markets: Listing shares on foreign stock exchanges to raise capital.

- International Bond Markets: Issuing bonds denominated in foreign currencies.

- Export Credit Agencies (ECAs): Government agencies that provide financing and insurance for international trade.

- Multilateral Development Banks (MDBs): International financial institutions that offer loans and other financial products for development projects.

The choice of financing source depends on factors like interest rates, currency denomination, and borrowing requirements.