AFM – Chapter 3: Acquisitions and mergers

Acquisitions and mergers

Key Points to Highlight in Chapter 3

Acquisition Process:

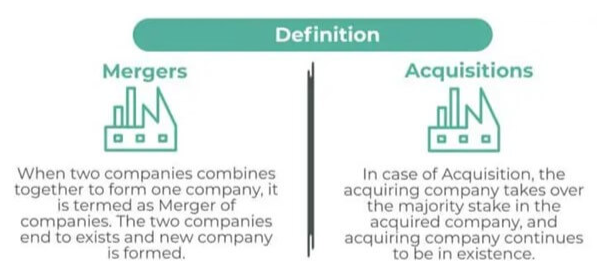

- Acquiring company absorbs target company’s operations.

- Maintains separate identity.

Motive for Mergers and Acquisitions:

- Synergy.

- Diversification.

- Cost reduction.

Enhancing Shareholder Value:

- Primary concern for acquiring company.

- Achieved through synergies, increased profitability, or strategic expansion.

Disadvantages of Mergers and Acquisitions:

- Integration challenges.

- Cultural differences, operational disruptions.

Types of Mergers:

- Horizontal: Same industry, market segment.

- Vertical: Same industry, different production stages.

- Conglomerate: Different industries.

Due Diligence Process:

- Assess legal, financial, and operational aspects.

- Regulatory compliance crucial.

Friendly Acquisition:

- Target company approves acquisition.

- Smooth transaction process.

Financing Methods:

- Equity financing, vendor financing, leverage buyouts.

Preventing Hostile Takeovers:

- Poison pill.

- White knight.

- Golden parachute.

Valuation Considerations:

- Market share, growth prospects, assets, liabilities.

Due Diligence Importance:

- Legal, financial, operational aspects assessed.

Defensive Strategies:

- Shark repellent.

- Poison pill.

Post-Merger Integration Objective:

- Maximizing shareholder value.

Benefits of Mergers and Acquisitions:

- Economies of scale, market power, access to new markets.

Post-Merger Integration Objective:

- Maximizing shareholder value.

Conglomerate Mergers:

- Diversify business operations.

- Reduce risk, capitalize on growth opportunities.

Synergy in M&A:

- May result in increased revenues, cost savings.

Hostile Takeover Characteristics:

- Resistance from target company’s management.

Disadvantages of Conglomerate Mergers:

- Reduced diversification.

Enhancing Shareholder Value Strategies:

- Golden parachute: Aligns interests with shareholders.

Topic 1: Acquisitions and Mergers versus Other Growth Strategies

(A) Arguments for and Against A&Ms

Arguments for A&Ms:

- Rapid growth: A&M’s offer a faster route to market expansion and increased resources compared to organic growth.

- Synergy benefits: Combining operations can create synergies, leading to cost reductions, revenue growth, and enhanced profitability.

- Increased market power: A&Ms can strengthen a company’s market position by acquiring competitors or complementary businesses.

- Access to new markets: Acquisitions can provide access to new customer bases and geographical markets.

- Tax advantages: A&Ms may offer tax benefits such as utilizing the target’s accumulated tax losses.

Arguments against A&Ms:

- Integration challenges: Merging cultures, systems, and processes can be complex and costly, leading to integration risks.

- Overvaluation: Acquirers may overpay for target companies, leading to negative shareholder value.

- Management distraction: A&M activity can divert management focus away from core business operations.

- Regulatory hurdles: Regulatory approvals can delay or even block A&Ms.

- Target company issues: Hidden liabilities or unforeseen problems with the target company can impact the acquirer.

(B) Evaluating Corporate and Competitive Nature

Corporate fit: Analyze the strategic fit between the acquirer and target. Do their business models, cultures, and product lines complement each other?

Competitive landscape: Assess the impact of the A&M on the competitive landscape. Will it create a monopoly or raise antitrust concerns?

(C) Choosing an Appropriate Target

Strategic fit: As mentioned above, the target’s strategy should align with the acquirer’s goals.

- Financial performance: Evaluate the target’s financial health, growth potential, and profitability.

- Market position: Consider the target’s market share, brand recognition, and customer base.

- Management team: Assess the target’s management capabilities and cultural compatibility.

(D) Reasons for A&M Failure

Overvaluation: Paying too much for the target leads to negative shareholder value.

- Integration difficulties: Poor planning and execution of the integration process can lead to operational inefficiencies and cultural clashes.

- Hidden liabilities: The target company may have undisclosed debts or legal issues.

- Synergy overestimation: Unrealistic expectations about synergy benefits can lead to disappointment.

(E) Evaluating Synergy Potential

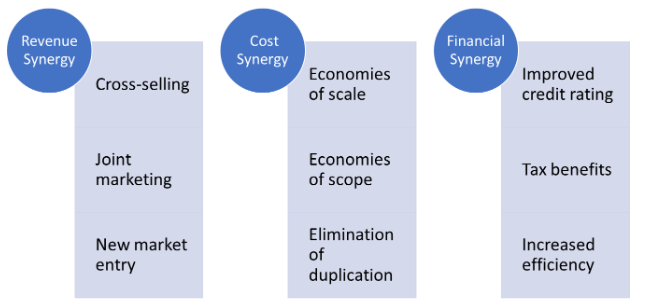

i) Revenue Synergy:

- Cross-selling: Selling the acquirer’s products to the target’s customer base and vice versa.

- Joint marketing: Combining marketing efforts to reach new customers or leverage existing strengths.

- New market entry: Utilizing the target’s distribution network to access new markets.

ii) Cost Synergy:

- Economies of scale: Combining purchasing power to negotiate lower prices with suppliers.

- Economies of scope: Sharing resources like staff, technology, or infrastructure to reduce costs.

- Elimination of duplication: Removing redundant functions or personnel across both companies.

iii) Financial Synergy:

- Improved credit rating: The combined entity may have a stronger credit rating, leading to lower borrowing costs.

- Tax benefits: Utilizing the target’s tax loss carryforwards.

- Increased efficiency: Sharing financial resources for improved cash flow management.

(F) Alternative Methods for Stock Listing

Special Purpose Acquisition Companies (SPACs): Shell companies that raise capital through IPOs and then acquire private companies.

Direct Listings: Companies go public by selling their shares directly on an exchange without issuing new shares.

Dutch Auctions: A selling auction where the initial price is high and is gradually lowered until there is a buyer.

Reverse Takeovers: A private company acquires a public company, gaining a stock listing through the backdoor.

Topic 2: Valuation for Acquisitions and Mergers

(A) Estimating Growth Levels

Internal Measures:

- Historical growth rates

- Budgeted growth rates

- Management forecasts

External Measures:

- Industry growth rates

- Growth rates of comparable companies

- Analyst forecasts

(B) Valuation Models

i) ‘Book Value-Plus’ Models:

- Adds a premium to the target’s net book value to account for intangible assets.

ii) Market-Based Models:

- Uses market multiples (e.g., P/E ratio) of comparable companies to value the target.

iii) Cash Flow Models, including Free Cash Flows:

- Discount the target’s future cash flows to their present value to arrive at a fair market value. Free cash flow (FCF) considers cash flow available to both equity and debt holders.

Considering Risk Profile Changes:

- The combined entity’s risk profile may change due to the A&M. Adjust discount rates or valuation multiples to reflect the new risk.

(C) Valuation Techniques

- Risk-Adjusted Cost of Capital (WACC): The required return on an investment considering the company’s risk profile. Used to discount cash flows in valuation models.

- Adjusted Net Present Values (NPVs): NPVs adjusted for the synergies expected from the A&M.

- Changing Price-Earnings Multiples (P/E): The P/E ratio of the acquirer may change post-A&M. Use this to adjust valuation based on market expectations.

(D) Valuing High-Growth Startups and Loss-Making Companies

- For high-growth startups, focus on future growth potential using venture capital valuation methods.

- For loss-making companies, discounted cash flow analysis may be challenging. Consider alternative methods like market multiples of comparable companies in similar situations.

Topic 3: Regulatory Framework and Processes

(A) Regulatory Framework

Factors influencing the framework:

- Competition policy: Regulators may scrutinize A&Ms to prevent monopolies and maintain healthy competition.

- Investor protection: Regulations aim to ensure fair disclosure of information and protect shareholder interests.

- National interests: Governments may have concerns about foreign ownership of strategic industries.

Shareholder vs. Stakeholder Model:

- Shareholder model: Focuses on maximizing shareholder value. Regulations may require fair disclosure for shareholders to make informed decisions.

- Stakeholder model: Considers the impact of A&Ms on employees, customers, and communities. Regulations might address employment rights or environmental concerns.

(B) Regulatory Issues and Target Defense Strategies

Regulatory issues:

- Antitrust concerns

- Takeover code compliance (e.g., disclosure requirements)

- Foreign ownership restrictions

Target defense strategies (against hostile bids):

- Poison pills: Issuing new shares to dilute the hostile bidder’s ownership.

- White knight defense:

A friendly company acquires the target.

- Pac-Man defense: The target attempts to acquire the hostile bidder.

Topic 4: Financing Acquisitions and Mergers

(A) Sources of Financing for Cash Acquisitions

- Debt financing: Borrowing money from banks or issuing bonds.

- Equity financing: Issuing new shares of the acquirer’s stock.

- Asset sales: Selling non-core assets to raise cash.

(B) Evaluating Financial Offers

Pure debt financing:

- Advantages: Low upfront cost, potential tax benefits of interest payments.

- Disadvantages: Increased financial risk, potential credit rating downgrades.

Mixed-mode financing:

- Combining debt and equity.

- Balances risk and cost considerations.

Recommendation:

- Consider factors like the acquirer’s financial strength, target valuation, and market conditions.

(C) Impact on Financial Performance

- Increased debt can lead to higher interest expenses and lower earnings.

- Equity issuance can dilute existing shareholders’ ownership.

- Successful A&Ms can improve profitability and cash flow in the long run.