F9 – Chapter 1: Financial Management Function

Financial Management Function

Key Points to Highlight in Chapter 1

Definition and Goals of Financial Management:

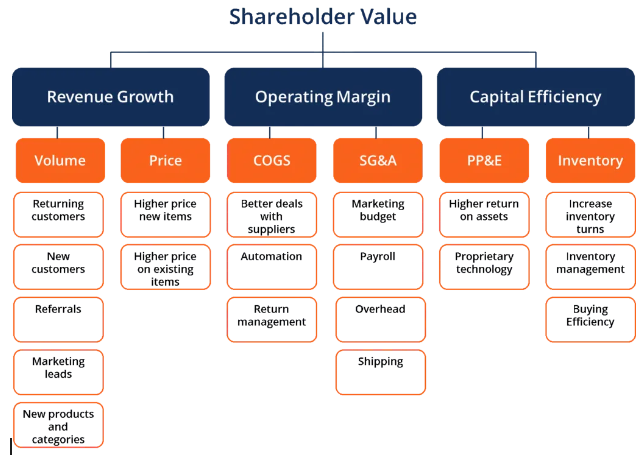

- Financial Management: Maximizing shareholder wealth by making decisions that increase the firm’s stock value.

- Primary Goal: Maximizing shareholder value through long-term value creation.

Financial Function and Planning:

- Financial Function: Managing cash flows, investments, and financial risk.

- Financial Planning: Achieving financial goals by effective resource management and strategic planning.

Financial Statements:

- Balance Sheet: Snapshot of financial position at a specific time.

- Income Statement: Reports financial performance over a period.

- Statement of Cash Flows: Details cash inflows and outflows during a period.

Financial Ratios:

- Current Ratio: Measures short-term liquidity.

- Debt-to-Equity Ratio: Assesses financial leverage.

- Return on Assets: Indicates profitability.

- Inventory Turnover Ratio: Measures inventory efficiency.

Financing Decisions:

- Advantage of Debt Financing: No dilution of ownership.

- Disadvantage of Equity Financing: Dilution of ownership.

Financial Derivatives and Risk Management:

- Financial Derivatives: Standardized contracts for risk management.

- Risk Management: Minimizing uncertainty through identifying, assessing, and mitigating risks.

Capital Budgeting and Financial Forecasting:

- Capital Budgeting: Evaluating long-term investment opportunities.

- Financial Forecasting: Predicting future financial outcomes based on historical data and trends.

Financial Decisions:

- Financing Decision: Determining optimal mix of equity and debt financing.

- Investment Decision: Evaluating investment opportunities.

- Dividend Decision: Deciding on dividend payouts.

- Working Capital Management Decision: Managing day-to-day expenses.

Limitations of Financial Ratios:

- Lack of comparability due to differences in accounting methods and reporting standards.

Statement of Cash Flows and Quick Ratio:

- Statement of Cash Flows: Details cash inflows and outflows.

- Quick Ratio: Measures liquidity excluding inventory, providing a conservative measure.

1. The Nature and Purpose of Financial Management

a) Nature and Purpose:

Financial management is the lifeblood of any organization, encompassing the activities involved in planning, acquiring, utilizing, and controlling financial resources to achieve organizational objectives. It serves a crucial role in:

- Maximizing shareholder value:

This involves ensuring that financial decisions are made in the best interests of the owners (shareholders) of the organization.

- Ensuring solvency and liquidity: Financial management ensures the organization has sufficient funds to meet its short-term and long-term obligations while maintaining the ability to operate effectively.

- Optimizing resource allocation: It involves making efficient use of financial resources to generate the highest possible returns on investments.

- Managing risk: Financial management identifies, assesses, and mitigates financial risks to ensure the organization’s financial stability.

b) Relationship with Accounting:

Financial management has a close relationship with both financial and management accounting:

- Financial accounting: Provides historical financial information used for financial analysis, decision-making, and reporting to external stakeholders.

- Management accounting: Focuses on providing internal stakeholders with forward-looking information and analyses to support planning, control, and decision-making.

Financial management utilizes information from both disciplines to make informed financial decisions, with financial accounting providing a solid foundation and management accounting offering specific insights for future endeavors.

2. Financial Objectives and the Relationship with Corporate Strategy

a) Relationship:

Financial objectives are specific, measurable goals that contribute to the achievement of the organization’s corporate strategy. The corporate strategy outlines the direction the organization intends to take to achieve its long-term goals and gain a competitive advantage. Financial objectives translate the broad aspirations of the corporate strategy into quantifiable targets for financial performance.

b) Various Financial Objectives:

- Shareholder wealth maximization: This objective prioritizes increasing the long-term value of the organization for its shareholders, typically measured by market capitalization.

- Profit maximization:

Aims to maximize the overall profit generated by the organization, often measured by net income.

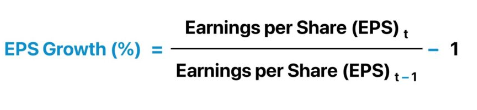

- Earnings per share (EPS) growth:

Focuses on increasing the earnings attributable to each outstanding share of stock, indicating growing profitability and potentially attracting investors.

It’s important to note that these objectives are not mutually exclusive and may sometimes conflict. Financial management involves striking a balance between these objectives while considering the overall corporate strategy and the interests of various stakeholders.

3. Stakeholders and Impact on Corporate Objectives

a) Range of Stakeholders and their Objectives:

An organization has a wide range of stakeholders with diverse objectives:

- Shareholders: Seek profit maximization, capital appreciation, and dividend payouts.

- Employees: Desire job security, fair wages, and healthy working conditions.

- Customers: Demand high-quality products and services at competitive prices.

- Creditors: Expect timely repayment of loans and interest.

- Government: Aims for economic growth, job creation, and tax revenue generation.

- Community: Desires environmental responsibility, ethical practices, and community engagement.

b) Conflict between Stakeholder Objectives:

The interests of different stakeholders may sometimes clash. For instance, increasing shareholder returns through cost-cutting measures might conflict with employee job security. Balancing these competing interests is a critical challenge for financial management.

c) Management’s Role and Agency Theory:

Management plays a pivotal role in mediating stakeholder interests and ensuring responsible decision-making. Agency theory suggests that managers (agents) act on behalf of owners (principals) and may have different goals. Financial management aims to align the interests of managers and shareholders by:

- Monitoring and performance evaluation: Tracking progress towards financial objectives and holding managers accountable.

- Compensation structures: Linking managerial rewards to achieving stakeholder objectives, such as performance-related pay or stock options.

d) Measuring Achievement of Objectives:

- Ratio analysis: Financial ratios like return on capital employed (ROCE), return on equity (ROE), EPS, and dividend per share (DPS) provide insights into profitability, efficiency, and shareholder returns.

- Changes in dividends and share prices: Tracking changes in dividends and share prices contributes to measuring total shareholder return (TSR), reflecting the overall wealth creation for shareholders.

e) Encouraging Achievement of Objectives:

- Managerial reward schemes: Share options and performance-related pay incentivize managers to align their decisions with long-term shareholder interests.

- Regulatory requirements: Corporate governance codes and stock exchange listing regulations promote ethical behavior, transparency, and stakeholder engagement, ultimately contributing to achieving overall objectives.

4. Financial and Other Objectives in Not-for-Profit Organizations

a) Value for Money (VfM):

For NPOs, Value for Money (VfM) is a crucial objective. VfM emphasizes optimizing the use of resources to achieve the maximum possible social impact. It ensures that:

- Resources are acquired efficiently and at a fair price.

- Activities are delivered effectively and achieve their intended outcomes.

- Outputs and outcomes are measured and monitored to demonstrate accountability and transparency.

b) Measuring Achievement in NPOs:

Measuring achievement in NPOs can be challenging due to the intangible nature of their objectives. However, several approaches are used:

- Output measures: Track the quantity of goods or services delivered (e.g., number of meals served, children educated).

- Outcome measures: Assess the impact of activities on beneficiaries (e.g., improvement in health, education levels).

- Efficiency measures: Evaluate the relationship between inputs (resources) and outputs/outcomes (e.g., cost per person served).

- Cost-effectiveness analysis: Compares the cost of alternative interventions to achieve the same outcome.

Additional Considerations:

- Financial sustainability: NPOs still need to ensure financial sustainability to maintain operations and fulfill their mission. This involves securing funding sources, managing costs effectively, and demonstrating financial prudence.

- Social responsibility and ethical considerations: NPOs have a responsibility to operate ethically and contribute positively to society. Financial management decisions should consider the ethical implications and potential social impact.

By understanding the unique objectives and challenges of NPOs, financial management can play a critical role in ensuring the effective use of resources and maximizing their social impact.

In conclusion, financial management is a crucial function for all organizations, regardless of their nature or objectives. By understanding the various theories, relationships, and challenges, financial managers can make informed decisions that contribute to the achievement of organizational goals while considering the interests of various stakeholders and operating within ethical and socially responsible frameworks.