F9 – Chapter 2: Financial Management Environment

Financial Management Environment

Key Points to Highlight in Chapter 2

Definition and Scope:

- Financial management environment encompasses internal and external factors.

- It involves factors influencing financial decision-making within an organization.

External Factors:

- External factors include economic conditions, government regulations, and financial markets.

- These factors shape the broader context within which financial decisions are made.

Internal Factors:

- Organizational culture, structure, and reporting mechanisms are internal factors.

- They influence employee behavior, attitudes, and decision-making processes.

Impact of Economic Conditions:

- Economic conditions affect the cost of capital and investment opportunities.

- Changes in interest rates, inflation, and GDP growth influence financial decisions.

Role of Financial Markets:

- Financial markets provide platforms for buying and selling financial assets.

- They facilitate capital allocation, price determination, and liquidity provision.

Technological Advancements:

- Technology improves the efficiency and accessibility of financial information.

- Digitalization, automation, and data analytics transform financial management practices.

Financial Globalization:

- Financial globalization promotes cross-border capital flows and market integration.

- It expands opportunities for investment, financing, and business expansion.

Political Instability:

- Political instability creates uncertainty and risk in the financial management environment.

- Changes in government policies and geopolitical tensions impact decision-making.

Regulatory Compliance:

- Financial regulators enforce compliance with laws and regulations.

- They ensure the integrity, stability, and transparency of financial markets.

Ethical Considerations:

- Ethical behavior enhances trust and credibility in financial markets.

- Financial managers must adhere to ethical standards to maintain integrity.

Risk Management:

- Risk management minimizes uncertainty and potential losses.

- It involves identifying, assessing, and mitigating risks associated with financial decisions.

Sustainability:

- Financial management in sustainability aims to minimize social and environmental impacts.

- It involves considering environmental, social, and governance (ESG) factors in decision-making.

Exchange Rates:

- Exchange rate fluctuations impact international trade and investment.

- Financial managers must manage currency risks to mitigate adverse impacts.

Corporate Governance:

- Corporate governance enhances accountability and transparency.

- It protects shareholder interests and promotes sustainable business practices.

Demographic Trends:

- Demographic shifts influence consumer behavior and market demand.

- Financial managers must address evolving market trends and preferences.

Topic 1: The Economic Environment for Business

a) Main macroeconomic policy targets:

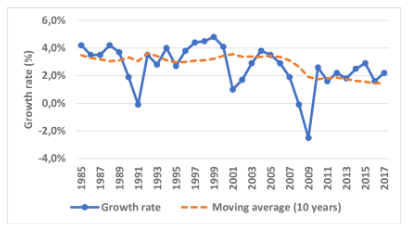

- Economic growth:

Achieving sustained increases in real GDP over time.

- Price stability:

Controlling inflation to maintain the purchasing power of currency.

- Full employment: Minimizing unemployment and maximizing the use of the workforce.

- Balance of payments equilibrium: Ensuring a balance between a country’s imports and exports, and its inflows and outflows of foreign currency.

b) Role of government policies:

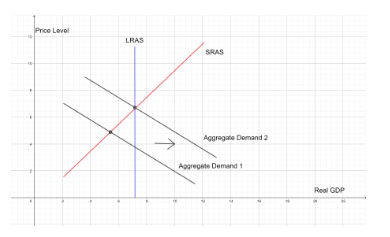

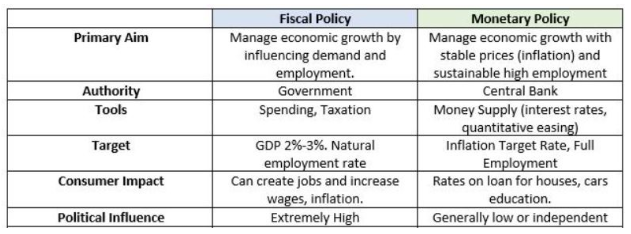

- Fiscal policy: Government spending and taxation decisions to influence aggregate demand and economic activity. Expansionary fiscal policy involves increased spending or reduced taxes to stimulate economic growth, and vice versa for contractionary policy.

- Monetary policy: Actions taken by the central bank to influence interest rates and the money supply. Lowering interest rates encourages borrowing and investment, potentially boosting economic growth.

- Interest rate policy: Central banks use various tools to influence short-term interest rates, impacting borrowing costs and investments.

- Exchange rate policy: Government interventions, sometimes in collaboration with other countries, to influence the exchange rate between domestic and foreign currencies.

c) Interaction with business planning and decision-making:

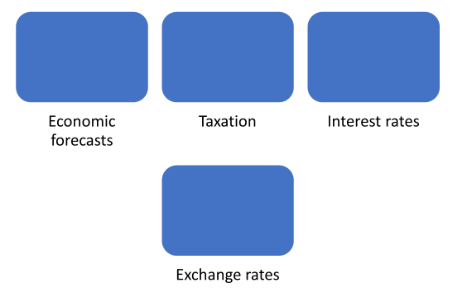

- Economic forecasts: Businesses use government economic policy forecasts to anticipate future economic conditions and adjust their plans accordingly.

- Taxation: Tax policies influence investment decisions, pricing strategies, and profit margins.

- Interest rates: Interest rates affect borrowing costs for investments and expansion plans.

- Exchange rates: Fluctuations can impact import and export costs, and the competitiveness of businesses in the global market.

d) Additional policy interactions:

- Competition policy: Promotes fair competition in markets, which can lead to lower prices, higher quality goods and services, and innovation. Businesses need to be aware of and comply with competition regulations.

- Government assistance: Grants, subsidies, and other support programs can encourage business development, particularly in targeted sectors or regions. Businesses can explore and potentially benefit from available government assistance programs.

- Green policies and sustainability: Regulations and incentives for environmental protection and sustainable practices can impact production costs, product development, and market access. Businesses need to adapt their strategies to comply with green policies and pursue sustainable practices.

- Corporate governance regulation: Establishes standards and requirements for corporate governance practices, which can influence decision-making processes, risk management, and transparency. Businesses need to adhere to corporate governance regulations.

Topic 2: The Nature and Role of Financial Markets and Institutions

a) Money and capital markets:

- Money markets: Provide short-term financing for businesses, governments, and individuals. Instruments include treasury bills, commercial paper, and certificates of deposit.

- Capital markets: Facilitate long-term financing for businesses and governments. Instruments include stocks, bonds, and derivatives.

- International markets: Connect domestic markets to international investors, providing access to global capital and diversification opportunities.

b) Role of financial intermediaries:

- Facilitate exchange: Connect borrowers and lenders by bringing together those seeking capital and those with surplus funds.

- Transform risk: Offer products tailored to different risk preferences, allowing risk-averse investors to access higher-risk assets with lower risk profiles.

- Improve efficiency: Provide information, transparency, and liquidity to financial markets, reducing transaction costs and increasing market participation.

c) Stock and bond markets:

- Stock market: Offers companies a platform to raise capital through the issuance of shares, allowing investors to participate in their ownership and potentially earn dividends.

- Corporate bond market: Provides companies with an alternative source of long-term financing through the issuance of bonds, which represent debt obligations with fixed interest payments.

d) Securities and risk/return trade-off:

- Different securities: Each type of security has unique characteristics that influence its risk and return potential. Examples include:

- Equities (stocks): High risk, high potential return.

- Bonds: Moderate risk, moderate return.

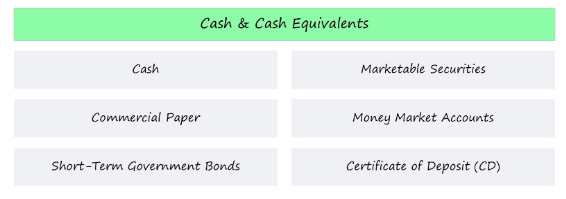

- Cash equivalents: Low risk, low return.

- Risk/return trade-off: Investors seek to balance risk and return when making investment decisions. Generally, higher potential returns are associated with higher risks.

e) Impact of Fintech:

- Fintech (financial technology): Utilizes technology to innovate and disrupt the financial services industry. Examples include:

- Online banking and payment platforms.

- Crowdfunding platforms.

- Robo-advisors and automated investment management.

- Impacts: Increased competition, accessibility, and efficiency in financial markets. Lower transaction costs and improved access to financial services for businesses and individuals.

Topic 3: The Nature and Role of Money Markets

a) Roles of money markets:

- Providing short-term liquidity: Businesses and governments use money markets to manage their cash flow needs. Businesses might borrow short-term funds to bridge temporary gaps between revenue and expenditure.

- Providing short-term trade finance: Facilitates the financing of international trade transactions. Instruments like letters of credit and documentary collections allow buyers to defer payment until they receive goods, while ensuring sellers receive payment.

- Managing foreign currency and interest rate risk: Businesses can utilize money markets to hedge their exposure to fluctuations in foreign currency exchange rates and interest rates. This allows them to mitigate potential losses arising from currency and interest rate movements.

b) Role of banks and other institutions:

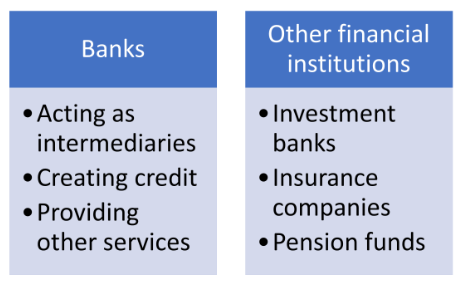

- Banks: Play a central role in the money market by:

- Acting as intermediaries: Connecting borrowers and lenders by accepting deposits and making loans.

- Creating credit: Through the fractional-reserve banking system, banks can expand the money supply by lending out a portion of deposited funds.

- Providing other services: Offering services like cash management, foreign exchange transactions, and investment products.

- Other financial institutions:

- Investment banks: Underwrite and issue securities, facilitate mergers and acquisitions, and provide other financial advisory services.

- Insurance companies: Invest a portion of premium income in money market instruments to meet short-term obligations and generate returns.

- Pension funds: Invest a portion of their assets in money market instruments to manage liquidity and generate income for future pension payments.

c) Money market instruments:

- Interest-bearing instruments:

- Certificates of deposit (CDs):

Time deposits offered by banks with a fixed interest rate and maturity date.

- Treasury bills: Short-term debt instruments issued by the government, offering a fixed interest rate and sold at a discount from face value.

- Discount instruments:

- Commercial paper: Short-term, unsecured promissory notes issued by corporations to raise funds. Sold at a discount from face value, with the investor earning the difference upon maturity.

- Derivative products:

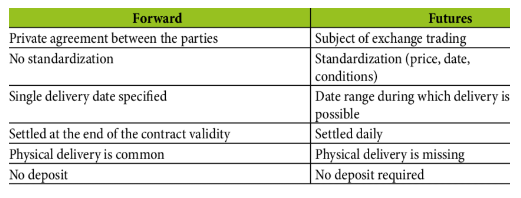

- Forward contracts: Agreements to buy or sell an asset at a predetermined price on a future date. Used to manage foreign currency and interest rate risk.

- Futures contracts: Standardized forward contracts traded on an exchange, providing greater liquidity and transparency.

Additional Notes:

- The choice of which financial instruments to utilize depends on factors like risk tolerance, investment horizon, and liquidity needs.

- Understanding the economic environment, financial markets, and money markets is crucial for businesses to make informed financial decisions, manage risks, and achieve their strategic objectives.