F9 – Chapter 3: Working Capital Management

Working Capital Management

Key Points to Highlight in Chapter 3

1. The nature, elements, and importance of working capital

Primary Goal:

- Maximizing shareholder wealth is the primary goal.

- It involves optimizing the balance between current assets and liabilities.

Components of Working Capital:

- Accounts receivable are a key component.

- They represent funds tied up in outstanding customer invoices.

Purpose:

- To optimize the balance between liquidity and profitability.

- Balancing current assets and liabilities efficiently.

Contribution to Financial Health:

- Improves cash flow and liquidity.

- Reduces the risk of financial distress.

Strategies to Reduce Cash Conversion Cycle:

- Increasing inventory turnover is effective.

- Shortening the time between cash outflows and inflows.

Measurement:

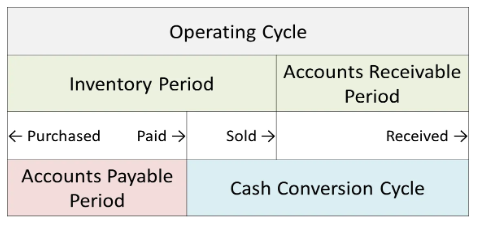

- Cash conversion cycle measures inventory conversion into cash.

- Includes days inventory outstanding (DIO), days sales outstanding (DSO), and days payable outstanding (DPO).

Improving Cash Flow from Operations:

- Shortening accounts receivable period is beneficial.

- Accelerates the conversion of accounts receivable into cash.

Impact of Aggressive Working Capital Management:

- Decreases liquidity by increasing current liabilities.

- Minimizes costs but increases risk.

Managing Accounts Payable:

- Effective management improves liquidity and cash flow.

- Optimizing payment terms with suppliers.

Efficiency Measurement:

- Accounts receivable turnover ratio measures efficiency.

- Indicates how quickly credit sales are collected.

Impact on Profitability:

- Increases profitability by reducing costs.

- Optimization of working capital components.

Cash Buffer:

- Maintained to cover short-term fluctuations.

- Ensures smooth operations and liquidity.

Extending Accounts Payable Period:

- Increases liquidity by delaying payments.

- Provides additional funds for other purposes.

Inventory Turnover Ratio:

- Measures efficiency in managing inventory levels.

- Compares cost of goods sold to average inventory.

Impact on Creditworthiness:

- Decreases credit risk by optimizing balance.

- Enhances creditworthiness in the eyes of lenders.

Accounts Receivable Turnover Ratio:

- Accelerates collections from customers.

- Improves cash flow by converting receivables into cash.

Working Capital Cycle:

- Represents the full operating cycle.

- From purchasing inventory to collecting cash from sales.

Benefits of Optimal Working Capital:

- Improved profitability by balancing assets and liabilities.

- Minimizes financing costs and enhances cash flow.

Impact on Cost of Capital:

- Decreases cost of capital by optimizing balance.

- Reduces need for external financing.

Aggressive Management and Cash Conversion Cycle:

- Decreases the cycle by reducing accounts payable period.

- Accelerates cash conversion and improves liquidity.

A) Nature and elements of working capital:

- Nature: Working capital is the net amount of current assets readily available to a business to meet its short-term obligations (current liabilities) and maintain its day-to-day operations. It acts as a lifeblood for businesses, ensuring smooth functioning and financial stability.

- Elements: Working capital comprises the following current assets:

- Inventory: Raw materials, work-in-progress, and finished goods awaiting sale.

- Accounts receivable: Amounts owed by customers for goods or services sold on credit.

- Prepaid expenses: Costs paid for in advance (e.g., rent, insurance)

- Marketable securities: Short-term investments easily convertible into cash. It also includes the following current liabilities:

- Accounts payable: Amounts owed to suppliers for goods or services purchased on credit.

- Accrued expenses: Expenses incurred but not yet paid (e.g., salaries, interest)

B) Objectives and conflict:

- Objectives: Working capital management aims to strike a balance between two primary objectives:

- Liquidity: Ensuring the ability to meet short-term financial obligations as they fall due.

- Profitability: Maximizing returns on investment by minimizing the amount of capital tied up in current assets.

- Conflict: These objectives can conflict. Holding high levels of current assets (inventory, receivables) improves liquidity but reduces profitability due to lost investment opportunities for the excess funds. Conversely, minimizing investment in current assets improves profitability but might compromise liquidity if cash is insufficient to meet obligations.

C) Central role in financial management:

Working capital management plays a crucial role in financial management for several reasons:

- Impacts financial health: Efficient working capital management ensures smooth operations, avoids financial distress, and contributes to overall financial well-being.

- Affects profitability: Optimized levels of current assets minimize idle capital and improve returns.

- Contributes to solvency: Maintaining adequate liquidity facilitates meeting short-term obligations and avoids potential insolvency.

- Impacts cash flow: Effective management of cash inflows and outflows optimizes cash availability.

2. Management of inventories, accounts receivable, accounts payable, and cash

A) Cash operating cycle and the role of accounts payable and accounts receivable:

- Cash operating cycle:

The time it takes to convert cash into inventory, sell inventory on credit, and collect cash from customers.

- Role of accounts payable and receivable:

- Accounts payable: Extend the cash operating cycle by allowing the purchase of inventory on credit, delaying cash outflow.

- Accounts receivable: Extend the cash operating cycle by providing goods or services on credit, delaying cash inflow.

B) Relevant accounting ratios:

- Current ratio: Current assets / Current liabilities – Measures short-term debt-paying ability. Higher ratios indicate better liquidity but might suggest inefficient use of resources.

- Quick ratio: (Current assets – Inventory) / Current liabilities – Excludes inventory (less liquid) from current assets for a more conservative liquidity measure.

- Inventory turnover ratio: Cost of goods sold / Average inventory – Measures how efficiently inventory is used and sold. Higher ratios indicate faster turnover and less capital tied up in inventory.

- Average collection period: Accounts receivable / Daily credit sales (365 / Credit period) – Measures the average time taken to collect payment from customers. Shorter periods indicate quicker cash collection.

- Average payable period: Accounts payable / Daily credit purchases (365 / Credit period) – Measures the average time taken to pay suppliers. Longer periods imply better use of trade credit and potentially lower financing costs.

- Sales revenue / Net working capital ratio: Sales revenue / (Current assets – Current liabilities) – Analyzes the efficiency of using working capital to generate sales. Higher ratios suggest better utilization of working capital.

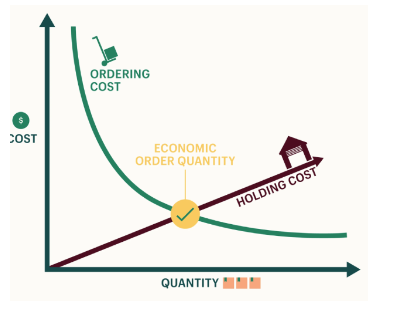

C) Inventory management techniques:

- Economic Order Quantity (EOQ) model:

Determines the optimal order quantity that minimizes total inventory holding and ordering costs.

- Just-in-Time (JIT) techniques: Aim to minimize inventory by receiving and using materials only when needed, reducing holding costs and improving efficiency.

D) Accounts receivable management techniques:

- Assessing creditworthiness: Evaluating customer’s ability to repay before granting credit, minimizing bad debts.

- Managing accounts receivable: Implementing efficient credit control procedures and monitoring outstanding balances.

- Collecting amounts owing: Implementing clear collection policies and pursuing overdue payments proactively.

- Offering early settlement discounts: Encouraging prompt payment by offering discounts for early settlement.

- Using factoring and invoice discounting: Selling accounts receivable to a third party for immediate cash, but at a discounted price.

- Managing foreign accounts receivable: Considering additional factors like exchange rate fluctuations and different legal and cultural environments.

E) Accounts payable management techniques:

- Using trade credit effectively: Negotiating favorable credit terms with suppliers, extending the payment period while maintaining good relationships.

- Evaluating benefits of early settlement and bulk purchase discounts: Weighing the benefits of early payment discounts against the potential for better deals through bulk purchases.

- Managing foreign accounts payable: Considering factors like currency fluctuations, import duties, and different payment methods.

F) Cash management techniques:

- Preparing cash flow forecasts: Estimating future cash inflows and outflows to identify potential shortfalls and surpluses.

- Assessing benefits of centralized treasury management and cash control: Consolidating cash management functions across the organization to improve efficiency and control.

- Cash management models:

- Baumol model: Determines the optimal cash balance to minimize total cash management costs, considering transaction costs and holding costs.

- Miller-Orr model: Similar to the Baumol model, but incorporates uncertainty in cash flows.

- Investing short-term: Investing excess cash in short-term, low-risk instruments to earn a return while maintaining liquidity.

3. Determining working capital needs and funding strategies

A) Level of working capital investment:

- Calculation: Working capital investment = Current assets – Current liabilities

- Factors determining the level:

- Length of the working capital cycle and terms of trade: Longer cycles and shorter credit periods from suppliers require higher working capital.

- Organization’s policy on current asset investment: Organizations might adopt a conservative, moderate, or aggressive approach.

- Industry: Different industries have varying working capital requirements based on their operating models and product characteristics.

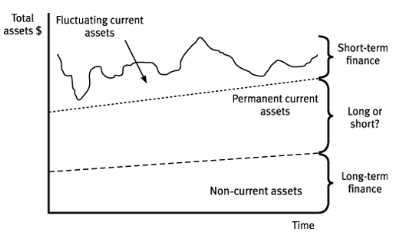

B) Working capital funding strategies:

- Permanent vs. fluctuating current assets:

Permanent: Consistently required for ongoing operations (e.g., minimum level of inventory). Funded with long-term financing.

Fluctuating: Varies depending on seasonal or cyclical factors. Funded with short-term financing.

Factors to consider:

-

- Relative cost and risk: Short-term financing is generally cheaper but carries higher risk of interest rate fluctuations. Long-term financing is costlier but provides more stability.

- Matching principle: Matching the maturity of financing with the use of funds (e.g., long-term financing for permanent assets).

- Funding policies:

- Aggressive: Minimize investment in current assets, relying heavily on short-term financing (higher risk).

- Conservative: Maintain higher working capital levels, using long-term financing (lower risk but potentially less profitable).

- Matching: Aim to match the maturity of financing with the use of funds (balanced approach).

- Management attitudes to risk, previous funding decisions, and organization size: Risk-averse management might prefer conservative policies. Previous financing decisions and the size of the organization can also influence strategy.

Additional notes:

- It is crucial to maintain a balance between liquidity and profitability when managing working capital.

- Effective communication and collaboration between various departments (finance, sales, purchasing) are essential for efficient working capital management.

- Continuous monitoring and adjustments to working capital strategies are necessary to adapt to changing business conditions and industry trends.