SBL – Chapter 2: Governance

Key Points to Highlight in Chapter 2

-

Corporate Governance Principles:

- Accountability, transparency, and independence are fundamental principles.

- Conflict of interest, although crucial, is not a standalone principle but a managed situation.

-

Board of Directors:

- Oversees governance implementation and sets strategic direction.

- Responsible for ensuring compliance, monitoring management performance, and protecting stakeholder interests.

- “Tone at the top” refers to ethical culture set by top management, influencing governance approach.

-

Governance Mechanisms:

- Executive compensation, Board composition, and shareholder activism align management and shareholder interests.

- Board evaluation and external advisors improve board effectiveness and governance practices.

-

Role of Shareholders:

- Electing the Board of Directors is a primary responsibility.

- Shareholder activism influences corporate decision-making through voting rights and engagement.

-

Principles of Corporate Governance:

- Fairness ensures equitable treatment of all shareholders.

- Integrity emphasizes honest and ethical behavior by directors and executives.

- Stakeholder inclusivity considers interests of all stakeholders, not just shareholders.

-

Committees in Corporate Governance:

- Audit Committee oversees financial reporting and internal controls.

- Remuneration Committee sets executive compensation.

- Nomination Committee identifies and nominates qualified directors.

- Risk Management Committee identifies and manages organizational risks.

-

External Auditors:

- Ensure compliance with accounting standards and provide assurance on financial statements.

-

Governance Codes and Standards:

- Code of Conduct outlines ethical guidelines and ensures legal compliance.

-

Purpose of Risk Management:

- Identifies, assesses, and manages risks to minimize uncertainty and potential harm.

Topic 1: Agency

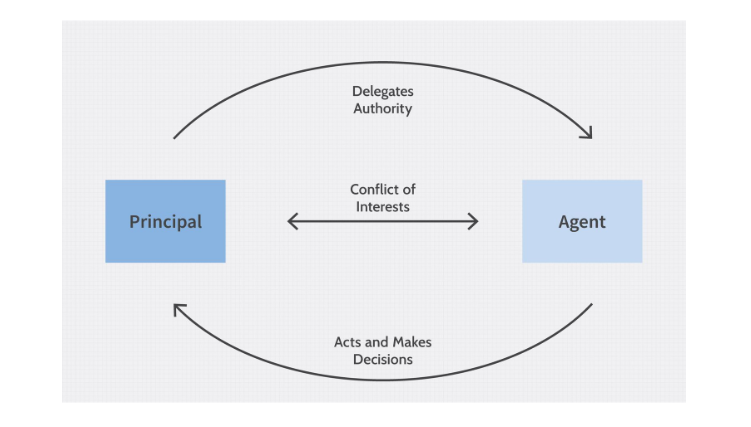

a) Principal-Agent Relationship in Governance:

- The principal-agent relationship arises when one party (the principal) appoints another party (the agent) to act on their behalf.

- In the context of governance, the shareholders are the principals, and the management is the agent.

- Issues:

- Information asymmetry: The agent may have more information than the principal, leading to potential conflicts of interest.

- Moral hazard: The agent may act in their own interests rather than the principal’s.

- Adverse selection: The agent may not be as competent or trustworthy as the principal believes.

- Governance mechanisms aim to mitigate these issues:

- Clear roles and responsibilities: Defining expectations for both the principal and the agent.

- Performance monitoring: Measuring the agent’s performance against agreed-upon objectives.

- Incentive structures: Aligning the agent’s interests with the principal’s through appropriate compensation and rewards.

b) Separation of Ownership and Control:

- Separation of ownership from control occurs when shareholders (owners) delegate decision-making authority to management (control).

- Issues:

- Agency problems: As discussed above, the separation can lead to conflicts of interest and potential misuse of power by management.

- Short-termism: Managers may prioritize short-term gains over long-term value creation for shareholders.

- Mitigating factors:

- Strong corporate governance: Implementing effective mechanisms to hold management accountable and ensure alignment with shareholder interests.

- Active shareholder engagement: Shareholders actively monitoring and influencing management decisions.

Topic 2: Stakeholder Analysis and Social Responsibility

a) Stakeholder Power and Interest:

- Stakeholders are any individuals or groups who can affect or are affected by an organization’s activities.

- Mendelow Matrix:

This model classifies stakeholders based on their power and interest in the organization:

- High power, high interest: Require close management and engagement (e.g., investors, employees).

- High power, low interest: May require monitoring but less active management (e.g., media).

- Low power, high interest: May require communication and engagement to manage their concerns (e.g., local communities).

- Low power, low interest: May require minimal specific action (e.g., general public).

- Application to Strategy and Governance:

- Understanding stakeholder power and interest helps organizations:

- Prioritize stakeholder engagement: Focus on those with the most significant influence.

- Develop strategies that consider stakeholder needs: Ensure long-term sustainability and social license to operate.

- Align governance practices with stakeholder expectations: Build trust and transparency.

- Understanding stakeholder power and interest helps organizations:

b) Stakeholder Roles, Claims, and Conflicts:

-

- Stakeholders have various roles:

- Investors: Provide financial resources and expect a return on investment.

- Employees: Contribute their skills and labor and expect fair compensation and working conditions.

- Customers: Purchase goods and services and expect quality, value, and ethical business practices.

- Suppliers: Provide materials and services and expect fair treatment and timely payments.

- Communities: Are impacted by the organization’s operations and expect responsible environmental and social practices.

- Stakeholder claims are their expectations from the organization. These claims can conflict, creating tension:

- Shareholders may prioritize profit maximization, while employees may prioritize job security.

- Customers may demand low prices, while suppliers may seek fair pricing and ethical sourcing practices.

- Resolving conflicts: Organizations can:

- Identify shared interests: Seek common ground among stakeholders.

- Prioritize and address critical stakeholder claims: Balance competing interests while considering the organization’s long-term viability.

- Engage in open and transparent communication: Explain decisions and rationale to stakeholders.

c) Social Responsibility and Corporate Citizenship:

- Social responsibility refers to an organization’s obligation to consider the impact of its activities on society and the environment.

- Viewing the organization as a ‘corporate citizen’ implies:

- Recognizing its role in contributing to the social and environmental well-being of the communities it operates in.

- Going beyond simply complying with the law and adopting ethical business practices that benefit society as a whole.

- Benefits:

- Enhanced reputation and brand image.

- Attracting and retaining talent.

- Building trust and legitimacy with stakeholders.

- Managing risks associated with social and environmental issues.

Topic 3: Governance Scope and Approaches

a) Institutional Investors and Governance:

- Institutional investors

(e.g., pension funds, investment companies) hold significant ownership in many companies.

- Roles and Influence:

- Active ownership: Actively engaging with companies to influence their governance practices and strategic direction.

- Voting rights: Exercising their voting rights on key issues such as board composition and executive remuneration.

- Proxy voting: Appointing others to vote on their behalf, influencing the outcome of shareholder meetings.

- Impact on Governance:

- Increased pressure for transparency and accountability: Pushing companies to improve governance standards.

- Focus on long-term value creation: Encouraging companies to adopt strategies that benefit all stakeholders, not just shareholders.

b) Rules-based vs. Principles-based Governance:

- Rules-based approach: Relies on specific rules and regulations to set governance standards.

- Advantages: Provides clarity and consistency.

- Disadvantages: Can be inflexible and may not adapt well to changing circumstances.

- Principles-based approach: Sets out broad principles to guide governance practices, allowing for flexibility in their application.

- Advantages: More adaptable and allows for customization based on an organization’s specific context.

- Disadvantages: Requires greater judgment and interpretation, potentially leading to inconsistencies in application.

- Appropriateness:

- Rules-based: May be suitable for simpler organizations or industries with high regulatory requirements.

- Principles-based: May be more appropriate for complex organizations or those operating in diverse environments.

c) Models of Organizational Ownership and Governance Regimes:

- Family firms: Ownership and control are concentrated within a family.

- Governance: Often informal and hierarchical, with family members holding key positions.

- Challenges: Potential for conflicts of interest, limited accountability, and difficulty in attracting and retaining external talent.

- Joint stock company-based models: Ownership is dispersed among many shareholders.

- Governance: Formal structures with clear separation of ownership and control, governed by boards of directors and a code of conduct.

- Challenges: Ensuring alignment of shareholder interests with those of other stakeholders and potential for short-termism.

d) ICGN Global Governance Principles:

- The International Corporate Governance Network (ICGN) has developed Global Governance Principles that provide guidance for good corporate governance. These principles address:

- Rights and equitable treatment of shareholders.

- Responsibilities of the board.

- Role of stakeholders in governance.

- Disclosure and transparency.

- Risk management.

- Remuneration.

- Organizations can apply these principles by:

- Integrating them into their governance framework.

- Regularly reviewing their practices against the principles.

- Disclosing how they adhere to the principles in their annual reports.

Topic 4: Reporting to Stakeholders

a) Factors Determining Reporting Policies:

- Factors influencing stakeholder reporting policies:

- Stakeholder power and interests: Organizations may prioritize reporting to stakeholders with greater power or influence.

- Regulatory requirements: Certain industries or jurisdictions may have specific reporting obligations.

- Cost-benefit considerations: Balancing the cost of comprehensive reporting with the benefits of transparency and stakeholder engagement.

- Organizational culture and values: Organizations committed to transparency and accountability are more likely to embrace comprehensive reporting.

b) Integrated Reporting and Sustainability Accounting:

- Integrated Reporting (IR) presents a holistic view of an organization’s performance, considering financial, social, and environmental aspects.

- Issues concerning accounting for sustainability:

- Lack of standardized metrics and frameworks: Makes comparisons between organizations challenging.

- Subjectivity in measuring and reporting non-financial information: Can lead to inconsistencies and difficulties in interpretation.

- Despite these challenges, IR offers:

- A more comprehensive understanding of an organization’s impact on society and the environment.

- Enhanced transparency and accountability to stakeholders.

- Improved decision-making by considering social and environmental factors.

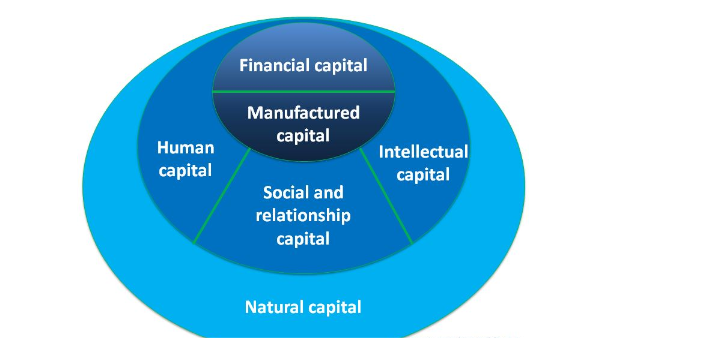

c) Guiding Principles, Content Elements, and Six Capitals of IR:

- Guiding principles of IR:

- Connectivity of information: All aspects of performance are interrelated and should be presented coherently.

- Stakeholder inclusiveness: Reports should consider the needs and interests of a broad range of stakeholders.

- Materiality: Only information that is significant to the organization and its stakeholders should be included.

- Clarity and conciseness: Information should be presented in a clear, concise, and understandable manner.

- Typical content elements of an IR:

- Strategy and governance: Addressing how the organization considers social and environmental factors in its strategy and governance.

- Performance: Reporting on the organization’s financial, social, and environmental performance.

- Future outlook: Discussing the organization’s plans and ambitions for addressing sustainability challenges.

- Six capitals of IR:

- Financial capital: Resources used to operate the business.

- Manufactured capital: Infrastructure and equipment used to produce goods and services.

- Intellectual capital: Knowledge, skills, and innovation.

- Human capital: Skills and capabilities of employees.

- Social and relationship capital: Relationships with employees, customers, and communities.

- Natural capital: Resources and services provided by the natural environment.

Topic 5: The Board of Directors

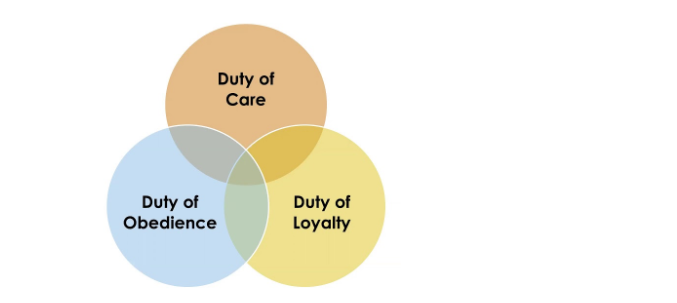

a) Duties and Roles of Directors:

- Directors’ duties:

- Duty of care: Act with reasonable skill and care in the best interests of the company.

- Duty of loyalty: Avoid conflicts of interest and act in good faith for the company’s benefit.

- Duty of obedience: Act within the powers conferred by the company’s constitution and the law.

- Board functions:

- Setting the company’s strategic direction.

- Appointing and overseeing the executive management team.

- Ensuring the company complies with legal and regulatory requirements.

- Approving major financial transactions.

- Monitoring risk management and internal controls.

- Maintaining strong corporate governance practices.

b) Unitary vs. Two-Tier Board Structures:

- Unitary board: A single board with both executive and non-executive directors.

- Advantages: Simpler structure, potentially more efficient decision-making.

- Disadvantages: Potential for conflicts of interest between management and oversight.

- Two-tier board: Separate supervisory and management boards.

- Advantages: Clear separation of duties, potentially stronger oversight.

- Disadvantages: More complex structure, potentially slower decision-making.

c) Non-Executive Directors (NEDs):

- NEDs are independent directors who are not employed by the company.

- Purposes:

- Provide independent oversight and challenge management.

- Bring diverse skills and experience to the board.

- Enhance the board’s credibility and reputation.

- Responsibilities:

- Attending board meetings and actively participating in discussions.

- Reviewing and challenging management proposals.

- Holding management accountable for performance.

- Representing the interests of shareholders and other stakeholders.

d) Induction, Performance Appraisal, and Continuing Professional Development (CPD) of Directors:

- Induction: Providing new directors with the knowledge and skills necessary to fulfill their role effectively.

- Performance appraisal: Regularly evaluating the performance of the board and individual directors.

- CPD: Ensuring directors maintain their knowledge and skills through ongoing training and development.

- Importance: These practices contribute to a well-functioning board that can effectively oversee the company and manage risks.

e) Diversity on the Board:

- Diversity refers to the variety of backgrounds, experiences, and perspectives represented on the board.

- Benefits of diversity:

- Improved decision-making through a wider range of viewpoints and experiences.

- Enhanced creativity and innovation.

- Stronger understanding of different stakeholder perspectives.

- Issues relating to diversity:

- Overcoming unconscious bias in director selection processes.

- Ensuring diverse individuals have the opportunity and support to succeed on the board.

- f) Importance and Roles of Board Committees:

- Main board committees:

- Audit committee: Oversees the integrity of financial reporting and internal controls.

- Remuneration committee: Sets the remuneration policy for directors and senior management.

- Nomination committee: Identifies and recommends candidates for board appointments.

- Risk committee: Oversees the identification, assessment, and management of risks.

- Importance: Committees allow for in-depth discussions and decision-making on specialized areas, improving board effectiveness.

g) Remunerating Directors:

- Principles of director remuneration:

- Performance-related: Linking pay to the company’s performance and individual director contributions.

- Transparent: Disclosing remuneration policies and individual director pay in the annual report.

- Aligned with stakeholder interests: Ensuring director pay is not excessive and aligns with the long-term interests of the company and its stakeholders.

- Factors to consider:

- Company size and complexity.

- Market practices.

- Directors’ skills and experience.

h) Regulatory, Strategic, and Labour Market Issues in Determining Director Remuneration:

- Regulatory issues: Compliance with relevant laws and regulations regarding director pay.

- Strategic issues: Aligning remuneration with the company’s long-term strategy and attracting and retaining talented directors.

- Labour market issues: Balancing the need to attract and retain directors with concerns about excessive pay and income inequality.

Topic 6: Public Sector Governance

- a) Public, Private, Charitable, and NGO Forms of Organization:

- Public sector:

Organizations funded and controlled by the government, providing public services (e.g., healthcare, education).

- Private sector: Owned and operated for profit by individuals or businesses.

- Charitable: Non-profit organizations established for public benefit.

- NGOs (Non-Governmental Organizations):

Non-profit organizations that operate independently of the government but may collaborate with them on various projects.

- Agency relationships:

- Government agencies may contract with private or non-profit organizations to deliver public services.

- This can raise concerns about accountability and transparency.

- Stakeholders’ objectives:

- Public sector organizations: Delivering public services efficiently and effectively, meeting social and environmental objectives.

- Private sector organizations: Maximizing profits for shareholders.

- Charitable and NGO stakeholders: Achieving their specific charitable missions.

- Performance criteria:

- Public sector: Effectiveness, efficiency, and equity in delivering public services.

- Private sector: Profitability, growth, and shareholder return.

- Charitable and NGOs: Achieving their specific charitable missions and impact.

b) Public Sector Strategic Objectives, Leadership, and Governance:

- Strategic objectives:

- Delivering public services efficiently and effectively.

- Achieving social and environmental objectives.

- Balancing competing demands and priorities.

- Leadership:

- Strong political leadership is crucial for setting direction and ensuring accountability.

- Public sector leaders face unique challenges, such as balancing political pressures with long-term goals.

- Governance arrangements:

- Strong governance frameworks are essential for ensuring transparency, accountability, and effective resource management.

- Public sector governance may involve:

- Ministries and departments: Responsible for specific policy areas.

- Parliament or legislature: Provides oversight and approves government budgets.

- Independent public bodies: Provide objective advice and scrutiny.

c) Democratic Control, Political Influence, and Policy Implementation:

- Democratic control: Citizens exercise indirect control through elected representatives.

- Political influence: Politicians may exert influence on public sector organizations to pursue their agendas.

- Policy implementation: Public sector organizations face challenges in translating policies into effective action, considering:

- Resource constraints: Public sector organizations often have limited resources compared to the private sector.

- Complexity of public services: Public services can be complex and involve multiple stakeholders.

- Accountability to multiple stakeholders: Public sector organizations need to balance the needs of various stakeholders, including the public, politicians, and employees.

d) Economy, Effectiveness, and Efficiency (3Es) and Promoting Public Value:

- 3Es: These are the criteria used to assess the performance of public sector organizations:

- Economy: Minimizing costs while achieving objectives.

- Effectiveness: Achieving the desired outcomes.

- Efficiency: Delivering services with minimal waste.

- Public value: Public sector organizations should strive to create value for society beyond simply delivering services efficiently. This includes:

- Meeting social and environmental objectives.

- Promoting equity and fairness.

- Building trust and legitimacy with the public.

By understanding the complexities of public sector governance and the unique challenges faced by public sector organizations, individuals can effectively manage risks and contribute to the delivery of essential public services.

This concludes the in-depth exploration of ACCA F9: Risk Management, covering the key topics, qualities, and frameworks within the chapters on leadership, organizational culture, professionalism, and public sector governance