F6 – Chapter 1: The UK Tax System

The UK Tax System

Key Highlights on Chapter 1

Government Taxation Impact

-

- Injects funds into the economy.

- Stimulates economic activity.

- Funds public services, infrastructure, and welfare programs.

Tax Policies to Discourage Activities

-

- Imposing duties on tobacco and alcoholic beverages.

- Deter consumption.

- Address public health concerns.

Purpose of Taxes like Capital Gains and Inheritance Tax

-

- Redistribute income and wealth.

- Promote equitable distribution of resources.

Types of Taxes

-

- Direct: Income tax.

- Indirect: Value Added Tax (VAT).

- Stamp duty land tax on property transactions.

Dispute Resolution

-

- Adjudicated by the Tax Tribunal.

- Independent body.

- Ensures fair resolution of tax disputes.

General Anti-Abuse Rule (GAAR)

-

- Empowers HMRC to counteract abusive tax arrangements.

- Targets artificial tax avoidance schemes.

- Upholds tax system integrity.

– Ethical Conduct and Professionalism

Accountant’s Duty

-

- Report significant errors or omissions.

- Cease to act for the client and inform HMRC.

- Uphold ethical and professional standards.

Reporting Suspicions

-

- Essential for combating tax evasion.

- Demonstrates integrity and compliance.

- Upholds regulatory standards.

– UK Tax System

Income Tax

-

- Progressive tax system.

- Based on the ability-to-pay principle.

- Current basic rate: 20%.

National Insurance Contributions

-

- Fund social security benefits.

- Contribute to the National Health Service (NHS).

Allowable Deductions

-

- Investment in new machinery.

- Capital allowances for business expenses.

Value Added Tax (VAT)

-

- Standard rate: 20%.

- Applied to most goods and services.

Stamp Duty Land Tax

-

- Levied on property transactions.

- Based on property value.

Inheritance Tax

-

- Tax on assets transferred upon death.

- Calculated on the estate’s value.

Corporation Tax

-

- Current rate: 20%.

- Applies to corporate entities.

– Self-Assessment Tax Return

Purpose

- Report income and calculate tax liability.

- Ensure accuracy of tax payments.

- Determine tax refunds or liabilities.

Topic 1. The overall function and purpose of taxation in a modern economy

Welcome to the intricate world of taxation, where we delve into its functions, structures, and impacts on modern economies. Buckle up, for this journey equips you not only with technical knowledge but also with the understanding of the economic, social, and fiscal purposes of taxation, its various forms, and its impact on individuals and businesses.

A. The Many Hats of Taxation: Purpose and Functions

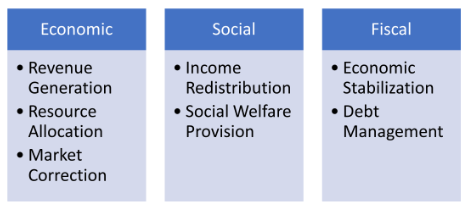

Economic:

-

- Revenue Generation: Funds essential government activities like infrastructure, public services, and social security. Imagine generating income to sustain public goods and services.

- Resource Allocation: Influences economic behavior by incentivizing or discouraging certain activities (e.g., tax breaks for research & development). Imagine shaping economic choices through tax incentives.

- Market Correction: Addresses market failures like externalities (e.g., pollution tax) and promotes economic efficiency. Imagine correcting imbalances and inefficiencies created by market forces.

Social:

-

- Income Redistribution:

Reduces income inequality through progressive taxation systems (higher taxes for higher earners). Imagine transferring wealth from rich to poor for social equity.

- Social Welfare Provision: Funds social programs like healthcare and education, promoting social mobility and well-being. Imagine financing essential services for societal betterment.

Fiscal:

-

- Economic Stabilization:

- Manages economic cycles by adjusting tax rates or spending to stimulate or restrain economic activity. Imagine using taxes to regulate inflation and counter recessions.

- Debt Management: Funds government debt repayment and avoids excessive borrowing that could harm the economy. Imagine balancing government spending with sustainable debt levels.

Illustrative Example: A government implements a carbon tax to discourage fossil fuel usage (economic and environmental), uses the revenue to fund renewable energy (economic and social), and adjusts tax rates during a recession to stimulate spending (fiscal).

B. Direct vs. Indirect: Decoding Tax Structures

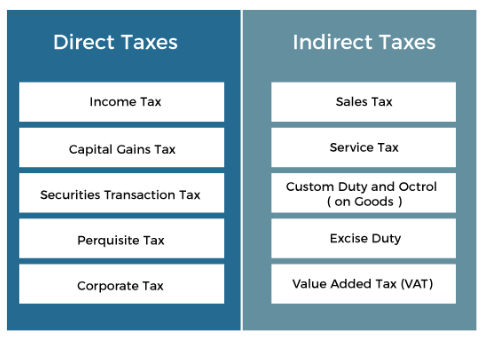

Direct Taxes: Levied directly on individuals or businesses based on their income, profits, or wealth. Imagine taxes directly linked to your earnings or assets.

-

- Examples: Income tax, corporation tax, capital gains tax, inheritance tax.

Indirect Taxes: Levied on the consumption of goods and services, typically embedded in the price and paid indirectly by consumers. Imagine taxes included in the cost of goods and services you purchase.

-

- Examples: Value-added tax (VAT), sales tax, excise duties (e.g., on tobacco, alcohol).

Remember: Direct taxes offer more flexibility for redistribution but can stifle economic activity, while indirect taxes are easier to administer but have less social impact. The optimal mix depends on specific economic and social goals.

C. A Taxing Landscape: Exploring Different Types

Capital Taxes: Levied on wealth or capital assets.

-

- Examples: Inheritance tax, wealth tax (rarely used), property tax.

Revenue Taxes: Levied on income or profits generated from economic activity.

-

- Examples: Income tax, corporation tax, capital gains tax.

Remember: Understanding different tax types and their characteristics is crucial for individuals and businesses to make informed financial decisions and comply with their tax obligations.

By actively engaging with these multifaceted aspects, you’ll transform your understanding from mere knowledge to profound wisdom, enabling you to:

- Analyze the economic, social, and fiscal effects of different tax policies.

- Evaluate the efficiency and fairness of various tax systems.

- Advise individuals and businesses on tax planning and compliance strategies.

- Contribute to informed discussions about the role of taxation in a modern economy.

Remember, taxation is a complex and dynamic area with far-reaching implications. By mastering these fundamentals, you become equipped to navigate the ever-evolving tax landscape and contribute to a sustainable and equitable tax system.

Topic 2. Principal sources of revenue law and practice

Welcome to an immersive journey into the intricate world of the UK tax system, where we uncover its structure, legal foundations, administrative framework, and ethical considerations. Buckle up, for this in-depth exploration unlocks not just technical knowledge, but also fosters a profound understanding of how laws, administration, and ethics orchestrate this vital system.

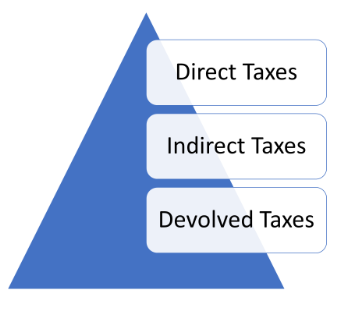

A. Navigating the Landscape: Unveiling the System’s Structure

- Direct Taxes: Levied directly on individuals or businesses based on their income, profits, or wealth (e.g., income tax, corporation tax, capital gains tax).

- Indirect Taxes: Embedded in the price of goods and services, paid indirectly by consumers (e.g., VAT, excise duties).

- Devolved Taxes: Certain taxes like Scottish income tax and Welsh income tax are administered by devolved administrations.

B. Building Blocks of Revenue Law: Recognizing the Sources

Legislation: Primary legislation enacted by Parliament forms the core framework (e.g., Income Tax Act 2007, Finance Acts).

- Secondary Legislation: Statutory instruments issued by the Treasury or HMRC provide detailed rules and procedures.

- Case Law: Court rulings interpret legislation and create legal precedents (e.g., decisions by the Court of Appeal or Supreme Court).

- Extra-Statutory Concessions: HMRC offers relief from specific tax liabilities in certain circumstances.

- Practice Statements and Manuals: HMRC guidance documents clarify interpretation of legislation and administrative procedures.

C. Exploring HM Revenue & Customs (HMRC)

Organization: Responsible for collecting taxes and duties in the UK, enforcing customs and excise regulations, and tackling tax evasion.

- Terms of Reference: Defined by legislation and ministerial statements, focusing on fairness, efficiency, and customer service.

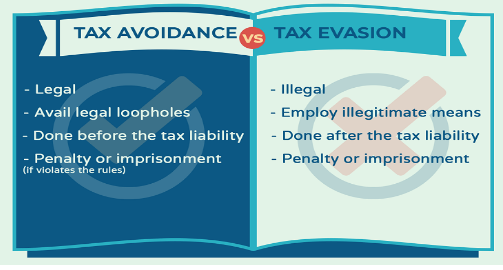

D. Ethics and Legality: Walking the Tightrope

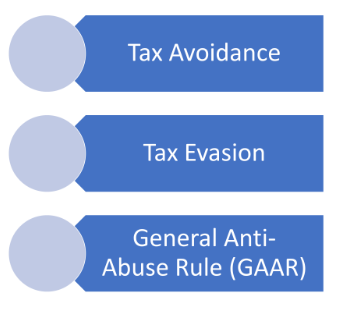

Tax Avoidance: Legal methods to minimize tax liability through careful planning and exploiting loopholes.

- Tax Evasion: Illegal activities to conceal income or assets to avoid paying taxes.

- General Anti-Abuse Rule (GAAR): Prevents misuse of tax arrangements that undermine the intended purpose of legislation.

Illustrative Example: A company structures its business to reduce its corporation tax liability through legitimate means (avoidance), while concealing offshore income to escape taxation entirely (evasion). GAAR could apply to counter the latter.

E. Bridging Borders: Understanding Interactions with Other Jurisdictions

Double Taxation:

Occurs when the same income or profits are taxed in two or more jurisdictions.

- Double Taxation Agreements (DTAs): Treaties between countries to avoid or relieve double taxation on residents of each country.

Illustrative Example: A UK resident earning income in France may face tax in both countries. A DTA between the UK and France could clarify taxing rights and avoid double taxation.

F. The Need for Collaboration: The Importance of Double Taxation Agreements

Prevent economic distortions: Encourage cross-border trade and investment by reducing tax burdens on multinational businesses and individuals.

- Promote fairness and efficiency: Ensure countries do not compete unfairly by levying excessive taxes on foreign residents.

- Reduce administrative burdens: Simplify tax compliance for individuals and businesses operating internationally.

G. Ethics and Professionalism: Cornerstones of the Tax System

- Professional Conduct: Adherence to ethical principles like objectivity, integrity, and confidentiality as outlined by professional bodies.

- Public Interest: Balancing individual client interests with broader societal needs for fair and efficient tax collection.

- Transparency and Trust: Upholding ethical standards to maintain public trust in the tax system.

By actively engaging with these multifaceted aspects, you’ll transform your understanding from mere knowledge to profound wisdom, enabling you to:

- Analyze the impact of different tax rules on individuals and businesses.

- Advise clients on tax planning strategies within legal and ethical boundaries.

- Evaluate the effectiveness of the UK tax system in achieving its economic and social objectives.

- Contribute to informed discussions about tax policy and international cooperation.

Remember: The UK tax system is constantly evolving, requiring ongoing learning and adaptation. By mastering these fundamentals and upholding ethical principles, you become a valuable asset in navigating the intricacies of taxation in a globalized world.

Topic 3. The systems for self-assessment and the making of returns

Welcome to the heart of the UK tax system, where we delve into its structure, legal foundations, administrative functions, and ethical considerations. Buckle up, for this journey equips you not only with technical knowledge but also with the understanding of how law, administration, and ethics shape the complex world of UK taxation.

A. Navigating the Labyrinth: Overall Structure of the UK Tax System

- Direct Taxes: Levied directly on individuals or businesses based on their income, profits, or wealth (e.g., income tax, corporation tax, capital gains tax).

- Indirect Taxes: Levied on the consumption of goods and services, typically embedded in the price and paid indirectly by consumers (e.g., VAT, excise duties).

- Devolved Taxes: Certain taxes like Scottish income tax and Welsh income tax are administered by devolved administrations.

B. Building Blocks of Revenue Law: Understanding the Sources

Legislation: Primary legislation enacted by Parliament forms the core framework (e.g., Income Tax Act 2007, Finance Acts).

- Secondary Legislation: Statutory instruments issued by the Treasury or HMRC provide detailed rules and procedures.

- Case Law: Court rulings interpret legislation and create legal precedents (e.g., decisions by the Court of Appeal or Supreme Court).

- Extra-Statutory Concessions: HMRC offers relief from specific tax liabilities in certain circumstances.

- Practice Statements and Manuals: HMRC guidance documents clarify interpretation of legislation and administrative procedures.

C. Exploring HM Revenue & Customs (HMRC)

Organization: Responsible for collecting taxes and duties in the UK, enforcing customs and excise regulations, and tackling tax evasion.

- Terms of Reference: Defined by legislation and ministerial statements, focusing on fairness, efficiency, and customer service.

D. Ethics and Legality: Navigating the Tightrope

- Tax Avoidance: Legal methods to minimize tax liability through careful planning and exploiting loopholes.

- Tax Evasion: Illegal activities to conceal income or assets to avoid paying taxes.

- General Anti-Abuse Rule (GAAR): Prevents misuse of tax arrangements that undermine the intended purpose of legislation.

Illustrative Example: A company structures its business to reduce its corporation tax liability through legitimate means (avoidance), while concealing offshore income to escape taxation entirely (evasion). GAAR could apply to counter the latter.

E. Crossing Borders: Tax Interactions with Other Jurisdictions

- Double Taxation: Occurs when the same income or profits are taxed in two or more jurisdictions.

- Double Taxation Agreements (DTAs): Treaties between countries to avoid or relieve double taxation on residents of each country.

Illustrative Example: A UK resident earning income in France may face tax in both countries. A DTA between the UK and France could clarify taxing rights and avoid double taxation.

F. The Need for Collaboration: Importance of Double Taxation Agreements

Prevent economic distortions: Encourage cross-border trade and investment by reducing tax burdens on multinational businesses and individuals.

- Promote fairness and efficiency: Ensure countries do not compete unfairly by levying excessive taxes on foreign residents.

- Reduce administrative burdens: Simplify tax compliance for individuals and businesses operating internationally.

G. Ethics and Professionalism: Cornerstones of the Tax System

Professional Conduct: Adherence to ethical principles like objectivity, integrity, and confidentiality as outlined by professional bodies.

- Public Interest: Balancing individual client interests with broader societal needs for fair and efficient tax collection.

- Transparency and Trust: Upholding ethical standards to maintain public trust in the tax system.

Remember: Understanding the structure, legal basis, and ethical considerations of the UK tax system empowers you to navigate complex tax issues, comply with regulations, and advocate for a fair and sustainable tax environment.

By actively engaging with these multifaceted aspects, you’ll transform your understanding from mere knowledge to profound wisdom, enabling you to:

- Analyze the impact of different tax rules on individuals and businesses.

- Advise clients on tax planning strategies within legal and ethical boundaries.

- Evaluate the effectiveness of the UK tax system in achieving its economic and social objectives.

- Contribute to informed discussions about tax policy and international cooperation.

Remember, the UK tax system is constantly evolving, requiring ongoing learning and adaptation. By mastering these fundamentals and upholding ethical principles, you become a valuable asset in navigating the intricacies of taxation in a globalized world.

Topic 4. The time limits for the submission of information, claims and payment of tax, including payments on account

Welcome to the world of self-assessment, where we delve into the intricacies of filing tax returns for individuals and companies in the UK. Buckle up, for this journey equips you not only with technical knowledge but also with the understanding of the key features, deadlines, and electronic filing requirements for navigating this essential process.

A. Individual Self-Assessment: Taking Control of Your Tax Affairs

Who must register: Individuals liable for income tax beyond PAYE (pay as you earn), including self-employed, landlords, and those receiving overseas income.

- Key Features:

- Annual Returns: Filed online or by paper form, reporting taxable income, deductions, and tax due.

- Payment Deadlines: First payment on account by 31st July, second by 31st January following the tax year.

- Penalties for Late Filing or Payment: Financial penalties accrue for late submissions or outstanding tax liabilities.

- Illustrative Example: A self-employed consultant files a self-assessment return reporting their business income, claiming allowable expenses, and calculating their final tax liability.

B. Corporate Self-Assessment: Filing for Your Company

Who must register: All limited companies registered in the UK, regardless of trading activity.

- Key Features:

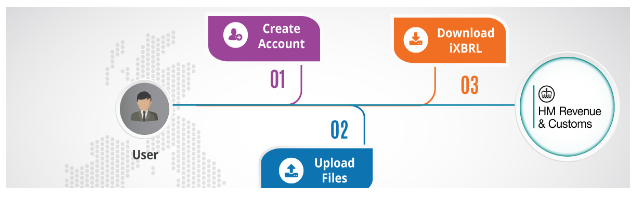

- Annual Corporation Tax Return: Filed online using iXBRL (Inline Extensible Business Reporting Language) format, reporting taxable profits, tax reliefs, and corporation tax due.

- Payment Deadlines: Corporation tax payable nine months after the accounting period end.

- Penalties for Late Filing or Payment: Similar to individual penalties, with additional surcharges for late iXBRL filing.

- iXBRL:

iXBRL Process

A mandatory electronic format for filing corporation tax returns, ensuring data accuracy and consistency.

- Illustrative Example: A limited company files its corporation tax return electronically using iXBRL, reporting its financial performance, claiming capital allowances, and calculating its corporation tax liability.

Remember: Both individual and corporate self-assessment systems require accuracy, timeliness, and adherence to electronic filing requirements.

Understanding and Applying Features:

- Identify individuals required to register for self-assessment based on their income sources.

- Calculate payment deadlines for individuals based on their tax liabilities.

- Explain the purpose and use of iXBRL in corporate self-assessment.

- Advise companies on deadlines and penalties for late filings or payments.

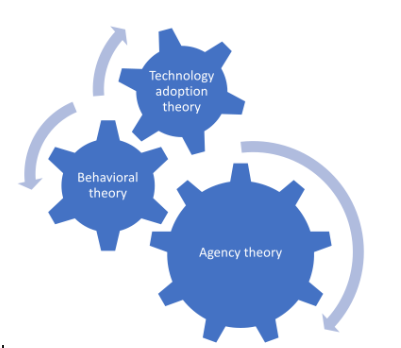

Theories and Illustrations:

- Agency theory: Explain the role of accountants as agents entrusted with clients’ tax compliance.

- Behavioral theory: Analyze factors influencing taxpayers’ compliance behavior, such as penalties and deadlines.

- Technology adoption theory: Discuss the challenges and benefits of transitioning to iXBRL filing.

By actively engaging with these aspects, you’ll transform your understanding from mere knowledge to profound wisdom, enabling you to:

- Assist individuals and companies in navigating the self-assessment process.

- Advise on filing deadlines, payment requirements, and potential penalties.

- Ensure accurate and timely submission of tax returns using appropriate e-filing methods.

- Contribute to a more efficient and compliant tax system for everyone.

Remember, self-assessment systems empower taxpayers to manage their tax liabilities proactively. By mastering these fundamentals and staying informed about updates, you become a valuable resource for individuals and companies navigating the ever-evolving tax landscape.

Topic 5. The procedures relating to compliance checks, appeals and disputes

Welcome to the intricate world of compliance checks, appeals, and disputes in the UK tax system, where we delve into the procedures and mechanisms available to both taxpayers and HM Revenue & Customs (HMRC) when disagreements arise. Buckle up, for this journey equips you not only with technical knowledge but also with the understanding of HMRC’s powers, taxpayer rights, and navigating the appeals process in both First-tier and Upper-tier Tribunals.

A. Scrutinizing Returns: HMRC’s Compliance Check Procedures

Triggers for a Compliance Check:

-

- Inconsistencies or discrepancies: Unusual deductions, large variations in income compared to industry norms, or unexplained wealth.

- Selective disclosure: Not reporting all taxable income or omitting relevant information.

- Third-party information: Data inconsistencies between reported income and information received from banks, employers, or other sources.

- Random selection: HMRC occasionally selects returns for random checks to maintain compliance and deter evasion.

Types of Checks:

-

- Enquiry Letters: Initial inquiries seeking clarification on specific aspects of the return.

- Aspect Enquiries: Focused investigations into specific areas (e.g., business expenses, rental income).

- Full Investigations: Comprehensive examination of all tax affairs, potentially involving third-party requests and interviews.

Taxpayer Rights:

-

- Right to be informed about the reasons for the check and its scope.

- Right to provide explanations and supporting documentation.

- Right to professional representation throughout the process.

- Illustrative Example: A self-employed builder consistently reports low profits despite having expensive cars and renovations. HMRC initiates a full investigation suspecting undeclared income.

B. Seeking Redress: The Appeals Process and Tribunals

- Dissatisfied with HMRC’s Decision: Taxpayers can appeal through a multi-step process.

-

- Internal Review: Seek reconsideration within HMRC by providing additional information or highlighting errors.

- Independent Review: Apply for an independent review by a senior HMRC officer not involved in the initial decision.

- Tax Tribunal: Appeal to the First-tier Tribunal (FTT) or Upper-tier Tribunal (UTT), depending on the complexity and value of the dispute.

- First-tier Tribunal (FTT):

- Handles most tax appeals under £50,000.

- Less formal than courts, allows informal evidence and personal representation.

- Decisions binding on both parties unless appealed further.

- Upper-tier Tribunal (UTT):

- Deals with complex appeals exceeding £50,000 and appeals against FTT decisions.

- More formal setting with legal representation often required.

- Decisions binding unless appealed to the Court of Appeal on a point of law.

- Theories and Illustrations:

- Natural justice: Analyse how appeals processes uphold principles of fairness and impartiality.

- Burden of proof: Explain who bears the responsibility to prove or disprove claims during an appeal.

- Case studies: Examine landmark tax tribunal cases to understand how arguments are presented and decisions reached.

By actively engaging with these aspects, you’ll transform your understanding from mere knowledge to profound wisdom, enabling you to:

- Advise taxpayers on their rights and options when facing HMRC compliance checks.

- Prepare and represent clients effectively during internal reviews and independent reviews.

- Guide clients through the appeals process to the FTT or UTT, considering complexity and financial implications.

- Develop analytical skills by applying legal and accounting principles to tax disputes.

Remember, compliance checks and appeals are critical components of a tax system, ensuring fairness for both taxpayers and the government. By mastering these complexities, you become a valuable resource for navigating tax controversies and upholding taxpayer rights.

Topic 6. Penalties for non-compliance

Welcome to the realm of penalties for non-compliance in the UK tax system, where we explore the consequences of failing to meet your tax obligations. Buckle up, for this journey equips you not only with technical knowledge but also with the understanding of late payment interest calculations, penalty types, and mitigating factors.

A. Counting the Cost: Calculating Late Payment Interest

Rate: HMRC charges a variable interest rate on late tax payments, currently set at 5% above the Bank of England base rate.

- Calculation: Interest accrues daily from the due date for payment until the tax is settled in full.

Formula:

- Interest = (Tax owed x Interest rate x Number of days late) / 365

- Illustrative Example: A company misses their corporation tax payment of £20,000 due on 9th September. They settle the payment 60 days late (on 7th November). Assuming a current interest rate of 7.5%, the late payment interest would be:

- Interest = (£20,000 x 7.5% x 60) / 365 = £500

Remember: Penalties are charged in addition to late payment interest, leading to significant financial burdens for non-compliant taxpayers.

B. The Spectrum of Penalties: Navigating the Consequences

- Types of Penalties:

- Late filing penalties: Fixed penalty for late submission of self-assessment returns, escalating over time.

- Late payment penalties: Percentage of tax owed based on the length of delay, increasing significantly the longer the overdue period.

- Failure to notify penalties: Charge for not informing HMRC of taxable income or changes in circumstances.

- Careless or deliberate errors penalties: Additional penalties based on a subjective assessment of taxpayer conduct.

- Penalties for deliberate evasion: Significant financial penalties and potential criminal prosecution.

- Mitigating Factors:

- Reasonable excuse for late payment or filing (e.g., serious illness, computer failure).

- Prompt corrective action taken and full cooperation with HMRC.

- Good compliance history prior to the non-compliance event.

- Theories and Illustrations:

- Behavioral theory: Analyze how penalties deter non-compliance and influence taxpayer behavior.

- Punishment vs. deterrence: Discuss the different purposes of penalties and their effectiveness.

- Case studies: Examine how HMRC applies penalties based on specific facts and circumstances.

By actively engaging with these aspects, you’ll transform your understanding from mere knowledge to profound wisdom, enabling you to:

- Calculate late payment interest for various tax liabilities and advise clients on potential costs.

- Identify different types of penalties applicable to specific non-compliance situations.

- Advise clients on mitigating factors that could reduce or avoid penalties.

- Promote tax compliance by educating clients about the financial consequences of non-compliance.

Remember, penalties are crucial for ensuring a fair and efficient tax system. By mastering these fundamentals, you become a valuable resource for clients navigating the complexities of compliance and minimizing potential penalties.