Introduction to business financial planning

Overview of Business Financial Planning

Definition and Importance

Business financial planning refers to the systematic process of outlining and managing a company’s financial resources to achieve specific business goals. It involves forecasting future financial performance, budgeting, and aligning the company’s financial strategy with its operational and strategic objectives. Financial planning serves as a roadmap that helps organizations make informed decisions about resource allocation, investment, and risk management.

Effective financial planning is essential because it allows businesses to anticipate financial needs, manage cash flow efficiently, and position themselves for sustainable growth. By understanding and preparing for financial challenges and opportunities, businesses can mitigate risks, maximize profitability, and enhance shareholder value.

Key Components of Financial Planning:

- Short-term and Long-term financial objectives

- Resource allocation

- Budget development

- Performance monitoring and adjustments

- Risk management

- Regulatory compliance

Objectives of Financial Planning

The primary objectives of business financial planning are multifaceted, encompassing both immediate and long-term goals. These objectives drive the framework for decision-making and help organizations stay competitive in dynamic markets. Below are some core objectives:

- To Achieve Financial Stability

Financial planning ensures that a business maintains a stable financial position by managing expenses, income, and resources effectively. It focuses on preventing financial crises such as liquidity shortages or debt accumulation that could undermine the organization’s health. - To Promote Growth and Expansion

Long-term financial planning focuses on scaling business operations through investments in new markets, technologies, or product lines. By planning for capital expenditures and growth strategies, businesses set a foundation for sustainable development. - To Manage Risks

Businesses face a variety of financial risks including market volatility, economic downturns, and unforeseen expenses. Financial planning minimizes these risks by creating buffers, diversifying income sources, and employing strategic risk management. - To Optimize Resource Utilization

The objective of financial planning includes maximizing the use of financial resources, ensuring that every dollar spent aligns with business objectives. Efficient allocation of funds promotes cost-effectiveness and value creation.

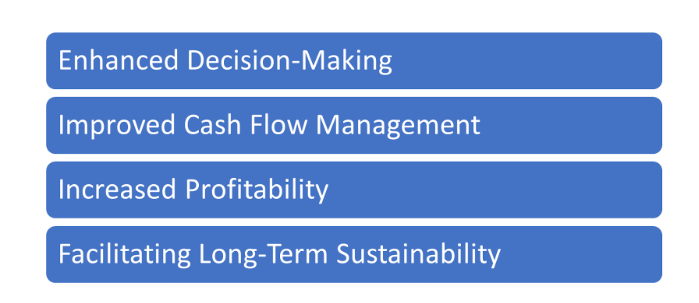

Benefits of Effective Financial Planning

Effective financial planning offers numerous benefits that contribute to business success. These include:

- Enhanced Decision-Making

With a comprehensive financial plan, management has access to data-driven insights that guide critical business decisions. This leads to better choices around resource management, market entry, and investment. - Improved Cash Flow Management

Proper financial planning ensures a steady flow of cash to meet operational expenses and investments. This mitigates the risk of cash shortages and allows for reinvestment in growth opportunities. - Increased Profitability

Financial planning helps identify cost-saving opportunities and ensures that resources are directed towards high-margin activities. This contributes to the overall profitability of the business. - Facilitating Long-Term Sustainability

Companies that engage in effective financial planning are better prepared to withstand economic fluctuations and industry disruptions. A well-rounded financial strategy supports long-term resilience and adaptability.

Financial Goals and Objectives

Setting Short-term and Long-term Goals

Financial goals in business are the milestones that guide an organization toward achieving its broader financial vision. These goals are typically divided into short-term (1-3 years) and long-term (5-10 years) objectives.

- Short-term Financial Goals focus on immediate results, such as improving liquidity, managing operational costs, or meeting quarterly performance targets.

- Long-term Financial Goals aim at sustainable business growth, expansion, market dominance, or securing long-term financial health through capital investments and diversification.

Examples of Short-term Financial Goals:

- Achieving a specific level of quarterly revenue.

- Maintaining a targeted gross profit margin.

- Reducing operating expenses by a certain percentage.

Examples of Long-term Financial Goals:

- Securing venture capital or external funding for expansion.

- Establishing a diversified product line within five years.

- Increasing the net worth of the business by a specific percentage over a decade.

Revenue Targets and Profitability

Revenue generation and profitability are core components of financial planning. A well-defined financial plan seeks to maximize profit margins through effective pricing strategies, operational efficiencies, and market expansion.

- Revenue targets are calculated by forecasting sales based on market research, customer behavior, and competitive analysis.

- Profitability is enhanced by controlling costs, diversifying product offerings, and implementing robust cost management practices.

Strategies for Achieving Profitability:

- Cost Efficiency: Reducing unnecessary expenses while maintaining product/service quality.

- Revenue Diversification: Avoiding over-reliance on a single revenue stream by expanding product offerings.

- Value-Based Pricing: Setting prices based on perceived value rather than simply cost-plus models.

Cash Flow Management

Effective cash flow management is critical for the success of any business. It involves tracking and managing the inflow and outflow of cash to ensure that operations run smoothly.

- Positive Cash Flow ensures that a business can meet short-term obligations and invest in growth opportunities.

- Negative Cash Flow, if not managed, can lead to financial strain, necessitating external financing or cost-cutting measures.

Techniques for Improving Cash Flow:

- Implementing timely invoicing and payment terms.

- Monitoring accounts receivable and payable effectively.

- Reducing excess inventory and overhead costs.

Financial Statement Analysis

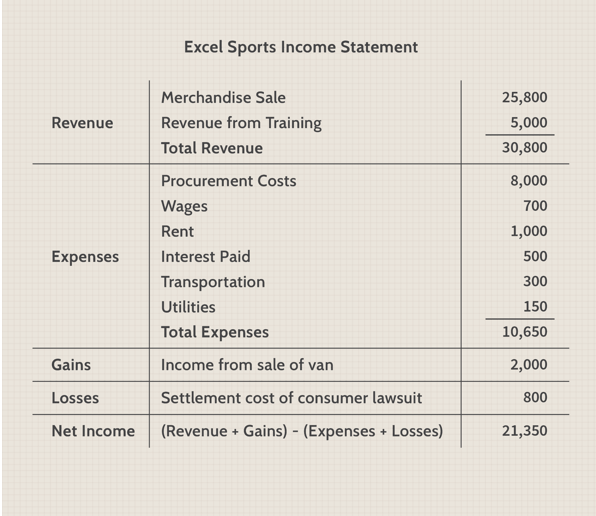

Income Statement

The income statement provides a snapshot of a company’s performance over a specific period. It reports revenue, expenses, and profit (or loss), helping businesses assess their operational health.

- Revenue: Total sales generated during a given period.

- Expenses: Cost of goods sold, operating expenses, and non-operating expenses.

- Net Income: The bottom-line profit after deducting all expenses from revenue.

Purpose: To evaluate financial performance, cost control, and profitability.

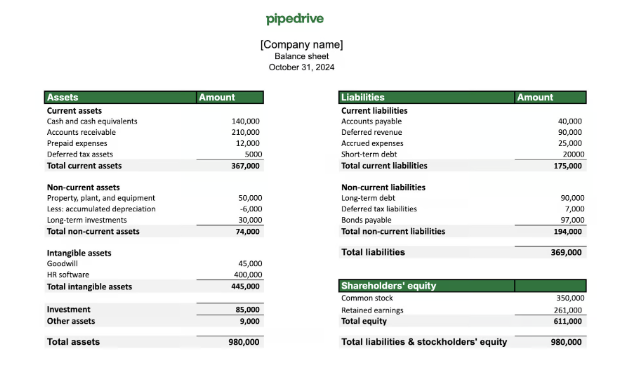

Balance Sheet

The balance sheet offers a snapshot of a company’s financial position at a specific point in time, detailing assets, liabilities, and equity.

- Assets: Resources owned by the business, both current (cash, accounts receivable) and non-current (property, equipment).

- Liabilities: Obligations owed, categorized into short-term and long-term liabilities.

- Equity: The net worth of the business, calculated as assets minus liabilities.

Purpose: To assess financial stability, solvency, and asset management efficiency.

Statement of Cash Flows

The statement of cash flows provides a detailed account of how cash is generated and used during a specific period.

- Operating Activities: Cash flows from daily business operations.

- Investing Activities: Cash used for or generated from acquiring assets or investments.

- Financing Activities: Cash flows from issuing or repaying debt or equity.

Purpose: To analyze liquidity, identify areas of surplus cash, and ensure financial sustainability.

Budgeting and Forecasting

Preparing a Business Budget

A business budget serves as a financial plan that allocates resources to achieve the business’s financial goals. It acts as a blueprint for managing income and expenses, helping businesses avoid overspending or deficits.

- Components:

Purpose: To provide a financial roadmap that aligns with operational activities.

Forecasting Sales, Expenses, and Profits

Forecasting involves predicting future financial outcomes based on historical data, industry trends, and economic factors.

- Sales Forecasting: Predicting future revenue levels to ensure alignment with capacity, staffing, and resources.

- Expense Forecasting: Anticipating costs to maintain cost-efficiency without exceeding budgetary limits.

- Profit Forecasting: Projecting net income and ROI based on sales and expense estimations.

Budget Control and Variance Analysis

Variance analysis compares the actual financial outcomes against the planned budget. This helps businesses understand deviations from projections and make adjustments as necessary.

- Favorable Variance: When actual financial results exceed budgeted amounts.

- Adverse Variance: When actual expenses or losses exceed budgeted amounts, requiring corrective actions.

Capital Management and Financing

Types of Financing: Debt vs. Equity

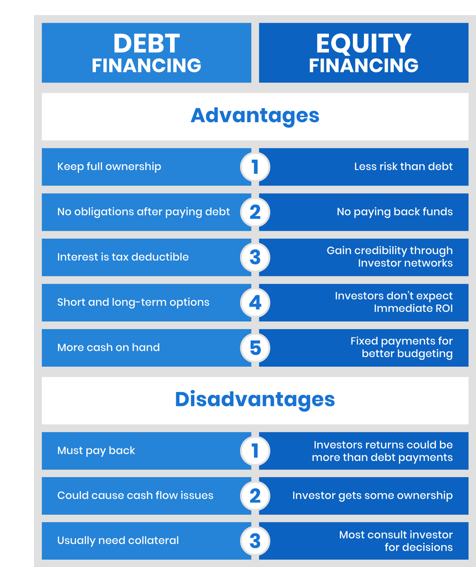

Businesses require capital to fund operations, expansion, and investment. Financing options are categorized into debt and equity.

- Debt Financing involves borrowing funds with an obligation to repay with interest (e.g., loans, bonds).

- Equity Financing involves raising funds by issuing ownership shares (e.g., venture capital, private equity).

Advantages and Disadvantages:

- Debt: Offers fixed payments and tax-deductible interest, but increases financial risk.

- Equity: Reduces debt obligations and does not require repayment, but dilutes ownership.

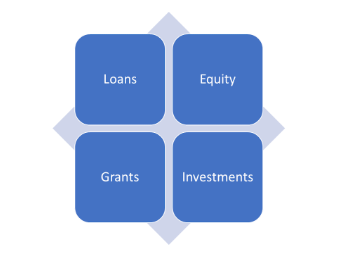

Financing Sources: Loans, Equity, Grants, and Investments

- Loans provide short-term and long-term financing for expansion, working capital, or refinancing.

- Equity financing is sourced from investors or shareholders in exchange for a stake in the business.

- Grants and subsidies provide non-repayable funding for specific projects or industries.

- Investments from venture capitalists, angel investors, or crowdfunding platforms fuel high-growth opportunities.

Capital Structure and Funding Decisions

Capital structure refers to the proportion of debt and equity used to finance business operations. A well-structured capital strategy balances risk and return to optimize shareholder value.

- Optimal Capital Structure seeks to minimize the cost of capital while maximizing growth and profitability.

Cost Management and Profitability

Cost Control Techniques

Effective cost management is critical for ensuring sustainable profitability. Techniques include:

- Activity-Based Costing (ABC): Allocating costs based on actual activities involved.

- Lean Management: Streamlining operations to reduce waste and improve efficiency.

- Vendor Negotiations: Managing supplier relationships to optimize procurement costs.

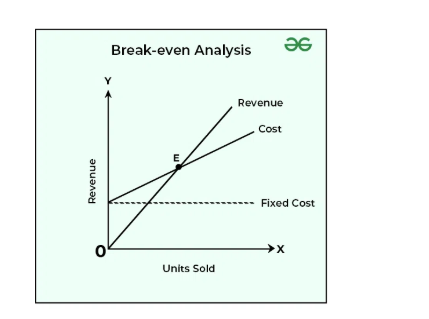

Break-even Analysis

Break-even analysis determines the point at which total revenues equal total costs, resulting in no profit or loss. It helps businesses understand the minimum performance required to cover expenses.

- Formula:

Break-even Point = Fixed Costs / (Selling Price per Unit – Variable Cost per Unit)

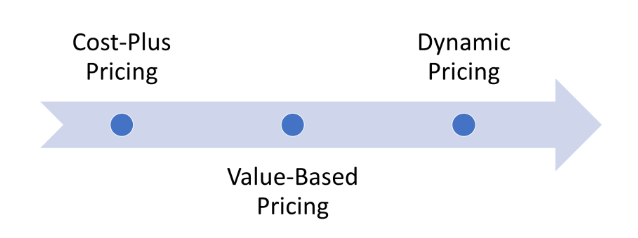

Pricing Strategies

Pricing decisions significantly impact a company’s profitability. Strategies include:

- Cost-Plus Pricing: Adding a margin to the cost of goods sold.

- Value-Based Pricing: Pricing based on customer perceived value.

- Dynamic Pricing: Adjusting prices based on demand fluctuations.

Risk Management and Financial Strategy

Identifying Financial Risks

Risk management is essential for minimizing financial exposure. Risks may include market risk, credit risk, operational risk, and regulatory risk.

- Market Risk: Vulnerability to economic fluctuations and industry-specific downturns.

- Credit Risk: Potential for loss from the failure of customers or counterparties to fulfill financial obligations.

- Operational Risk: Risks associated with business processes, technology, or human error.

Mitigating Risks through Financial Planning

Effective financial planning helps mitigate risks through:

- Diversification of revenue streams.

- Implementing contingency reserves.

- Regularly monitoring financial health through forecasting and analytics.

Financial Decision-Making

Strategic financial decision-making involves evaluating trade-offs between risk and reward to achieve the best outcomes for stakeholders.

Regulatory and Compliance Considerations

Financial Reporting Standards

Businesses are required to adhere to established financial reporting standards (e.g., GAAP, IFRS), ensuring transparency and consistency in financial reporting.

Tax Planning and Compliance

Effective tax planning involves structuring finances to minimize tax liabilities while maintaining compliance with local, state, and federal regulations.

Legal and Regulatory Obligations

Companies must navigate a complex landscape of legal and regulatory requirements, including financial audits, employment laws, data protection, and industry-specific compliance standards.

Real-Life Illustration: “The Coffee Cart Start-Up”

Business Overview:

- Business Name: Brew & Go (Mobile Coffee Cart)

- Industry: Food & Beverage (Coffee)

- Owner: Jason, a budding entrepreneur passionate about providing high-quality coffee to people on the go.

- Goal: To launch a mobile coffee cart business that serves high-quality coffee to busy professionals and tourists in high-traffic areas.

Step 1: Understand the Importance of Business Financial Planning

Jason knows that successful businesses require more than just a good product; they need to have solid financial planning. He understands that without proper financial planning, even the best business ideas can fail due to poor cash flow management, unanticipated expenses, or unrealistic revenue expectations.

Action:

- Jason sets aside time to understand the key components of financial planning:

- Budgeting: Knowing how much money is needed to start and run the business.

- Forecasting: Estimating future sales and expenses.

- Financial Statements: Understanding how to track income, expenses, and profits.

- Cash Flow Management: Ensuring there’s enough cash to cover day-to-day operations.

- Funding: Identifying how to finance the business (e.g., loans, personal savings, investors).

Step 2: Start with a Business Budget

Jason’s first task is to create a comprehensive business budget. This budget will guide his decisions and help him estimate his initial costs, ongoing expenses, and potential revenue.

Action:

- Initial Costs (Start-Up Expenses):

- Coffee Cart: $15,000

- Equipment (espresso machine, grinders, etc.): $5,000

- Inventory (coffee, cups, etc.): $1,500

- Permits & Licenses: $500

- Marketing (website, flyers): $1,000

- Insurance: $600

- Total Start-Up Costs: $23,600

- Ongoing Expenses (Monthly):

- Coffee & Supplies (e.g., beans, milk, cups): $2,000

- Staff (2 baristas): $4,000

- Vehicle Maintenance (for cart): $500

- Marketing & Advertising: $300

- Insurance: $50

- Miscellaneous: $150

- Total Monthly Expenses: $7,950

- Expected Revenue:

- Average sales per day: 100 cups @ $4 per cup = $400/day

- Monthly revenue: $400/day * 30 days = $12,000/month

Jason calculates the break-even point by comparing his monthly expenses with his expected revenue:

- Break-even Point = Total Monthly Expenses / Average Sales per Day

- Break-even = $7,950 / $400 = 19.88 days (approximately 20 days)

So, Jason needs to sell 100 cups per day for 20 days in a month to cover his expenses. Anything beyond that will contribute to profits.

Step 3: Forecast Sales and Profitability

Next, Jason forecasts his sales to understand whether his business can be profitable. He needs to account for seasonality, special events, and market trends.

Action:

- Market Research: Jason surveys the target area (busy downtown location, office parks, tourist areas) to determine the demand for coffee.

- Forecast:

- Average cups sold on weekdays: 120/day

- Average cups sold on weekends: 150/day (due to higher foot traffic)

Jason calculates his potential monthly sales based on this forecast:

- Weekday Sales: 120 cups/day * 20 weekdays = 2,400 cups

- Weekend Sales: 150 cups/day * 8 weekends = 1,200 cups

- Total Monthly Sales = 2,400 + 1,200 = 3,600 cups

- Monthly Revenue = 3,600 cups * $4 = $14,400

Jason now has a better understanding of his projected revenue and can compare it to his ongoing expenses.

Step 4: Financial Statements and Cash Flow

Jason needs to understand how to track income, expenses, and cash flow to ensure the business stays financially healthy.

Action:

- Income Statement: This statement shows Jason’s monthly income, expenses, and profits.

- Revenue: $14,400

- Cost of Goods Sold (COGS): $2,000 (for coffee, milk, and supplies)

- Gross Profit: Revenue – COGS = $14,400 – $2,000 = $12,400

- Operating Expenses: $7,950 (as calculated in the budget)

- Net Profit: Gross Profit – Operating Expenses = $12,400 – $7,950 = $4,450

Jason now has a clear view of his net profit: $4,450 per month.

- Cash Flow Management: Jason also tracks his cash flow to ensure he can cover his bills. Cash flow shows the actual movement of money in and out of the business.

- Starting Cash Balance: $5,000 (from savings)

- Monthly Revenue: $14,400

- Monthly Expenses: $7,950

- Ending Cash Balance = Starting Cash Balance + Revenue – Expenses = $5,000 + $14,400 – $7,950 = $11,450

Jason needs to ensure his business maintains positive cash flow to pay for expenses and reinvest in the business.

Step 5: Funding and Financing the Business

Jason now realizes that he needs $23,600 to start his coffee cart business. Since he doesn’t have the entire amount in savings, he considers options for financing.

Action:

- Personal Savings: Jason has $10,000 in personal savings.

- Business Loan: Jason applies for a small business loan of $15,000 from a local bank, offering a 5% interest rate over 5 years.

After securing the loan, Jason now has the capital he needs to purchase the coffee cart, equipment, and initial inventory.

Step 6: Regular Financial Reviews

Once the business is up and running, Jason understands the importance of regular financial reviews to stay on track. Every month, he will:

- Revisit his budget to compare actual expenses and sales with projections.

- Adjust his financial plans based on changes in the market (e.g., slower winter months might require reducing staff hours or adjusting inventory orders).

- Track growth and reinvest profits into marketing and expanding his product offerings.

Step 7: Preparing for Growth and Scaling

After operating successfully for 6 months, Jason considers the possibility of expanding his coffee cart business by:

- Launching a second cart in a new location.

- Increasing the product range to include more snacks and specialty drinks.

- Hiring additional staff to handle the increased demand.

Jason revisits his financial plan, adjusts his forecasts, and creates a budget for the next 12 months to accommodate the growth.

Outcome:

Thanks to a well-structured financial plan, Jason’s coffee cart business is running smoothly. By sticking to his budget, forecasting sales accurately, tracking cash flow, and securing necessary funding, he has achieved profitability within the first year and is now exploring ways to scale.

Summary of Key Takeaways:

- Business Budgeting: Calculate start-up costs, monthly expenses, and expected revenue to ensure financial sustainability.

- Sales Forecasting: Estimate future sales based on market research and seasonal trends to avoid under or overestimating revenue.

- Financial Statements: Use income statements and cash flow statements to track business performance.

- Funding and Financing: Seek funding options (e.g., loans, savings) to cover start-up costs.

- Regular Reviews: Continuously monitor finances, adjust plans, and reinvest in the business for growth.

By following a solid business financial plan, Jason is able to manage his resources effectively, stay on top of financial obligations, and set the foundation for long-term business success.

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.