Expense Ratio Rule for Business Success

Introduction to Expense Ratio

Definition of Expense Ratio

The Expense Ratio is a financial metric used to evaluate how efficiently a business manages its expenses relative to its revenue. It provides insight into the proportion of total expenses against the revenue earned and helps identify areas where a company may need improvement in controlling costs. This ratio is commonly expressed as a percentage and is instrumental for business managers and investors to assess financial health.

Importance in Business Financial Health

Expense Ratio is crucial for understanding the operational efficiency of a business. High ratios indicate excessive spending relative to revenue, which could affect profitability and overall sustainability. Conversely, a lower Expense Ratio suggests efficient cost management, contributing positively to a company’s bottom line. Investors and stakeholders often use this ratio to gauge the financial health and operational effectiveness of an organization.

Components of Expense Ratio

Operating Expenses

Operating expenses refer to the costs that a business incurs during its normal operations, excluding the direct costs associated with producing goods or services. These include administrative expenses, rent, utilities, marketing, salaries, and office supplies. Efficient management of operating expenses ensures that businesses can allocate resources towards growth and development.

- Examples:

- Marketing and advertising costs

- Salaries and wages for non-production staff

- Office rent and utilities

- Professional services like accounting and legal fees

Cost of Goods Sold (COGS)

COGS represents the direct costs associated with producing goods or services that are sold to customers. It is a crucial component of the Expense Ratio because it directly impacts the profitability of the business. Understanding and managing COGS is essential for pricing strategies and maintaining competitive pricing.

- Examples:

- Raw materials and components

- Direct labor costs

- Manufacturing overhead, such as machinery and equipment depreciation

- Factory supplies and utility costs directly related to production processes

Other Administrative Expenses

Administrative expenses are those costs that are necessary for the operation of the business but are not directly related to the production or sales of products or services. These may include expenses for human resources, office supplies, technology, insurance, and general management.

- Examples:

- Employee benefits for administrative staff

- IT infrastructure and software costs

- Office management and maintenance

- Travel expenses for administrative personnel

Calculating Expense Ratio

Formula:

Expense Ratio=(Total Expenses/Total Revenue)×100

Breakdown of Key Financial Metrics Used

Calculating the Expense Ratio involves summing up various components of expenses and dividing them by the total revenue. This gives a clear view of how efficiently a business is managing its resources.

- Total Expenses: Sum of all operating expenses, COGS, and administrative expenses.

- Total Revenue: Income generated from sales or services provided.

The resulting percentage represents the proportion of expenses consumed relative to total income.

For example, if a business has $200,000 in expenses and $1,000,000 in revenue, the Expense Ratio would be:

(200,000/1,000,000)×100=20%

Benchmarking Expense Ratios

Industry Standards

Expense Ratios can vary significantly between industries, depending on factors like market conditions, competition, and business size. For example, a technology firm may have a higher Expense Ratio compared to a retail business due to increased research and development costs. Benchmarking allows businesses to measure themselves against peers and industry averages to identify areas for improvement.

Comparing with Competitors

Analyzing competitors’ Expense Ratios is a valuable exercise for businesses looking to enhance operational efficiency. By understanding how rivals manage costs, businesses can adopt similar strategies or innovate to gain a competitive edge. Comparative analysis helps set realistic financial goals and identifies areas where adjustments are required to stay competitive.

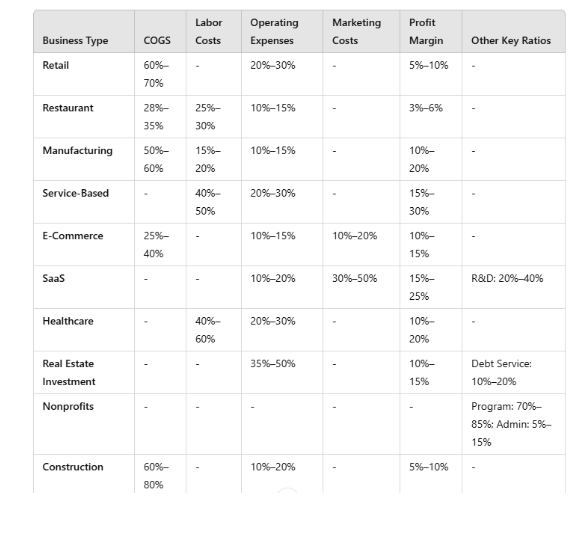

Expense ratios can vary significantly depending on the type of business, industry standards, and operational efficiency. Below are some common expense ratios for different types of businesses:

1. Retail Businesses

- Cost of Goods Sold (COGS): 60%–70% of revenue.

- Operating Expenses: 20%–30% of revenue.

- Profit Margin: 5%–10%.

2. Restaurants

- COGS (Food and Beverage Costs): 28%–35% of revenue.

- Labor Costs: 25%–30% of revenue.

- Operating Expenses: 10%–15% of revenue.

- Profit Margin: 3%–6%.

3. Manufacturing Businesses

- COGS: 50%–60% of revenue.

- Labor Costs: 15%–20% of revenue.

- Overhead Costs: 10%–15% of revenue.

- Profit Margin: 10%–20%.

4. Service-Based Businesses (Consulting, Legal, etc.)

- Labor Costs: 40%–50% of revenue.

- Overhead Costs: 20%–30% of revenue.

- Profit Margin: 15%–30%.

5. E-Commerce Businesses

- COGS (including shipping): 25%–40% of revenue.

- Marketing Expenses: 10%–20% of revenue.

- Operating Expenses: 10%–15% of revenue.

- Profit Margin: 10%–15%.

6. Software-as-a-Service (SaaS) Companies

- R&D Costs: 20%–40% of revenue.

- Sales and Marketing: 30%–50% of revenue.

- General and Administrative (G&A): 10%–20% of revenue.

- Profit Margin: 15%–25%.

7. Healthcare (Private Practices, Clinics)

- Labor Costs: 40%–60% of revenue.

- Operating Expenses: 20%–30% of revenue.

- Profit Margin: 10%–20%.

8. Real Estate Investment

- Operating Expenses (Maintenance, Taxes, Insurance): 35%–50% of revenue.

- Debt Service: 10%–20% of revenue.

- Profit Margin: 10%–15%.

9. Nonprofits

- Program Expenses: 70%–85% of revenue.

- Administrative Costs: 5%–15% of revenue.

- Fundraising Costs: 5%–15% of revenue.

10. Construction Companies

- Direct Costs (Materials, Subcontractors): 60%–80% of revenue.

- Overhead: 10%–20% of revenue.

- Profit Margin: 5%–10%.

Key Considerations:

- Ratios can differ based on scale (small vs. large businesses), location, and specific niche within the industry.

- Expense ratio benchmarks for a specific business can be compared to industry averages through market research or industry reports.

- Keeping a close watch on variable costs (e.g., labor, materials) and fixed costs (e.g., rent, utilities) can help optimize these ratios.

5. Importance of Expense Ratio for Business Success

Impact on Profitability

A lower Expense Ratio directly contributes to increased profitability. By maintaining control over expenses, businesses can ensure that a higher percentage of revenue is directed towards profit margins. Conversely, a high Expense Ratio can erode profit margins, making it challenging for businesses to scale effectively.

Influence on Business Growth

Businesses with a manageable Expense Ratio are more likely to reinvest profits into expansion and innovation. Reducing expenses can free up capital for marketing, product development, and new market opportunities, fostering long-term growth.

6. Strategies to Optimize Expense Ratio

Cost Cutting Measures

One of the most straightforward ways to manage Expense Ratio is through reducing unnecessary expenditures. Cost-cutting strategies can involve:

- Eliminating redundant operations

- Automating routine tasks

- Streamlining procurement processes

- Negotiating better terms with suppliers

Revenue Growth Initiatives

Increasing revenue without proportionally increasing expenses is another effective approach. Strategies may include:

- Expanding product lines or services

- Entering new markets or geographies

- Enhancing pricing models or value propositions to attract more customers

7. Challenges in Managing Expense Ratio

Balancing Growth vs. Costs

Achieving a balanced Expense Ratio is a delicate process. Companies must manage expenses without stifling innovation or growth opportunities. While cost-cutting measures can lead to short-term savings, they may negatively impact long-term performance if they hinder business development.

Market Fluctuations and Cost Management

Economic fluctuations, industry shifts, or changes in consumer behavior can create challenges in managing Expense Ratios. Businesses need to adapt quickly to these changes, ensuring that they remain agile while maintaining operational efficiency.

8. Case Studies & Real-World Examples

Analyzing Successful Businesses’ Expense Ratios

Case studies of companies like Amazon, Apple, and Tesla showcase how effective management of Expense Ratios contributes to business success. For example, Apple maintains a lower Expense Ratio compared to competitors, focusing heavily on innovation and cost-effective operations.

Common Mistakes and How to Avoid Them

Mistakes such as over-reliance on debt to finance operations or failure to scale expenses with revenue growth are common pitfalls. By addressing these issues through careful planning and regular monitoring, businesses can optimize their Expense Ratios effectively.

9. Technology & Tools for Tracking Expense Ratios

Financial Software

Advanced financial tools and software help businesses track their Expense Ratios in real-time. These tools automate the calculation of expenses and revenues, making it easier to analyze performance and make data-driven decisions.

Automated Reporting Systems

Automated systems provide insights into various cost centers, allowing for a granular approach to expense management. Businesses can set alerts for excessive spending, track budget variances, and ensure compliance with financial goals.

10. Monitoring and Reviewing Expense Ratios

Regular Assessments

To ensure that Expense Ratios remain optimal, businesses must conduct regular assessments. These reviews should include a thorough evaluation of operational expenses and adjustments to budgeting and forecasting strategies as necessary.

Adjustments Based on Business Changes

Businesses must be flexible in adjusting their Expense Ratios in response to changes such as market shifts, technological advancements, or economic downturns. Staying proactive helps maintain a healthy balance between costs and revenue, contributing to sustainable business growth.

Real-Life Illustration

The Expense Ratio Rule is a crucial concept for maintaining business profitability and ensuring long-term sustainability. It helps business owners understand how much of their revenue is being spent on operating expenses, and ultimately, how much profit they are able to retain. Below is a detailed, step-by-step illustration to demonstrate how the Expense Ratio Rule works in real life.

Case Scenario: “Healthy Bites Café”

Business Overview:

- Business Name: Healthy Bites Café

- Industry: Food & Beverage (Healthy fast casual restaurant)

- Owner: Mia, an entrepreneur passionate about healthy eating and sustainability.

- Goal: To open a café that serves fresh, nutritious meals with a focus on sustainability, while ensuring profitability and financial stability.

Step 1: Understanding the Expense Ratio Rule

Before opening her café, Mia learns about the Expense Ratio Rule — which states that the total operating expenses (excluding profit) should ideally not exceed a certain percentage of revenue.

The general rule of thumb for many businesses is that:

- Operating Expenses (including rent, salaries, utilities, etc.) should ideally be 50% or less of revenue for a healthy profit margin.

- Depending on the industry and business model, some businesses may operate successfully with a higher or lower expense ratio, but 50% is a good benchmark.

The goal is to make sure that the business is not overspending on operational costs, which would eat into profits.

Step 2: Mia’s Startup and Initial Financial Setup

Mia’s Startup Costs: Before opening the café, Mia works on calculating her startup costs. These are one-time expenses that are required to open the café.

- Lease Deposit & Rent (First 3 Months): $6,000

- Renovations and Equipment (kitchen, seating, etc.): $25,000

- Initial Inventory (food, drinks, packaging): $3,000

- Permits & Licenses: $1,000

- Marketing and Branding: $2,500

- Miscellaneous (furniture, decor): $2,000

Total Startup Costs = $39,500

After securing a loan of $40,000 (which includes a buffer for unexpected costs), Mia’s café is ready to open.

Step 3: Projecting Revenue and Operating Expenses

Mia projects the following for her café’s monthly revenue and operating expenses:

Projected Revenue:

- Mia anticipates serving 200 customers per day, spending an average of $15 each.

- Monthly Revenue = 200 customers/day * $15 * 30 days = $90,000/month

Operating Expenses (Monthly): Mia calculates the expected monthly operating expenses, which include all ongoing costs to run the café. She divides them into different categories:

- Cost of Goods Sold (COGS): The cost of ingredients and materials used to prepare the meals.

- Monthly COGS = $25,000

- Staff Salaries: Wages for baristas, cooks, servers, and the café manager.

- Monthly Staff Salaries = $20,000

- Rent: The monthly lease for the café space.

- Monthly Rent = $3,000

- Utilities (electricity, water, etc.): Monthly cost to run utilities.

- Monthly Utilities = $1,000

- Marketing & Advertising: Budget for online ads, flyers, and promotions.

- Monthly Marketing = $500

- Miscellaneous Expenses: Any other costs, like cleaning supplies, office supplies, and maintenance.

- Monthly Miscellaneous = $500

Total Monthly Operating Expenses = $25,000 (COGS) + $20,000 (Staff Salaries) + $3,000 (Rent) + $1,000 (Utilities) + $500 (Marketing) + $500 (Miscellaneous) = $50,000

Step 4: Calculating the Expense Ratio

Mia now calculates her Expense Ratio to evaluate whether her café’s expenses are within a reasonable range of the revenue.

Expense Ratio Formula:

Expense Ratio=Total Operating ExpensesTotal Revenue×100

- Expense Ratio Calculation:

Expense Ratio=50,00090,000×100=55.56%

Mia’s current expense ratio is 55.56%, which means that for every $1 of revenue, 55.56 cents go toward operating expenses.

Step 5: Interpreting the Expense Ratio and Making Adjustments

Mia’s expense ratio of 55.56% is higher than the ideal target of 50%. This suggests that Mia is spending a bit too much on operations, which could limit her profitability. She needs to look at her expenses and identify areas where she can reduce costs without compromising the quality of service.

Actions Mia Takes to Improve the Expense Ratio:

- Reduce COGS:

- Mia renegotiates prices with her food suppliers and looks for bulk purchasing options to lower the cost of ingredients.

- Savings: $2,000 per month.

- Optimize Staffing:

- Mia analyzes the staffing schedule and finds that she is overstaffed during slow hours, so she reduces shifts during non-peak times.

- Savings: $1,000 per month.

- Cut Marketing Costs:

- While marketing is important, Mia realizes she can use more cost-effective strategies like social media ads and partnerships with local businesses instead of print flyers.

- Savings: $200 per month.

- Reduce Miscellaneous Expenses:

- Mia finds a more affordable cleaning service and lowers her miscellaneous expenses.

- Savings: $300 per month.

Adjusted Operating Expenses = $50,000 – ($2,000 + $1,000 + $200 + $300) = $46,500

Step 6: Recalculating the Expense Ratio After Adjustments

Mia now recalculates her expense ratio after making the adjustments:

New Expense Ratio Calculation:

- Expense Ratio=46,50090,000×100=51.67%

Though the expense ratio is still above the 50% target, it has decreased from 55.56% to 51.67%. Mia is now closer to her goal, but she understands that continuous monitoring and cost management are essential for improving profitability.

Step 7: Ongoing Financial Monitoring and Fine-Tuning

Mia continues to monitor her expense ratio monthly and looks for additional ways to optimize her expenses as the business grows. Some strategies she considers include:

- Increasing Sales: Mia plans a seasonal menu update to attract new customers and increase sales.

- Energy Efficiency: Mia invests in energy-efficient equipment to lower utility costs in the long term.

- Menu Pricing: Mia periodically reviews the menu and adjusts prices based on the rising cost of ingredients or customer preferences.

Mia’s goal is to maintain her expense ratio below 50% while ensuring that her business provides high-quality food and service.

Outcome:

By adhering to the Expense Ratio Rule and consistently reviewing her operating expenses, Mia improves her profitability. She successfully reduces her expense ratio and positions her café for sustainable growth and success. Through a proactive approach to managing costs, Mia ensures that Healthy Bites Café remains financially healthy and can reinvest profits into expanding the business.

Key Takeaways:

- Expense Ratio Rule: A good rule of thumb is to keep operating expenses under 50% of revenue to maintain healthy profitability.

- Ongoing Monitoring: Regularly review and adjust your expenses to ensure profitability.

- Cost-Cutting Strategies: Identify areas where costs can be reduced without sacrificing quality (e.g., renegotiating supplier contracts, optimizing staffing).

- Profitability: Keeping expenses in check allows for more revenue to translate into profit, which is crucial for long-term business success.

By following these steps and focusing on maintaining an optimal expense ratio, business owners like Mia can ensure financial health and profitability for their ventures.

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.