The ABC’s of Personal Finance

The ABC’s of Personal Finance

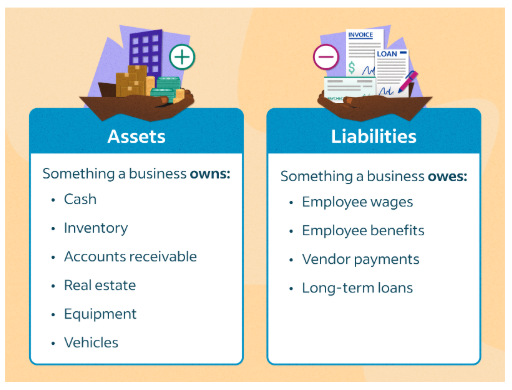

A – Assets

Understanding Different Types of Assets

Assets are valuable items or resources that individuals or businesses own, which can be used to generate wealth or meet financial obligations. In personal finance, understanding the types of assets is crucial for managing and growing wealth effectively.

i. Tangible Assets

- Tangible assets are physical items with a measurable value, such as real estate, vehicles, and personal possessions.

- Real Estate: Residential properties, commercial buildings, and land that provide rental income, appreciation, or equity growth.

- Vehicles: Cars, boats, and other personal transportation that may depreciate over time but can still be assets depending on ownership and value.

ii. Financial Assets

- These include investments and financial products like stocks, bonds, mutual funds, and retirement accounts.

- Stocks: Equity shares in publicly traded companies offer potential returns through capital appreciation and dividends.

- Bonds: Fixed-income securities where investors lend money to governments or corporations in exchange for interest payments over time.

- Mutual Funds: A pool of funds managed by professionals that invests in a diversified portfolio of stocks, bonds, or other securities.

iii. Intellectual Property and Digital Assets

- Assets such as patents, copyrights, trademarks, and digital assets like cryptocurrencies and NFTs (Non-Fungible Tokens).

- These assets often have a high growth potential and can be leveraged for significant financial gain, especially in technology and creative industries.

iv. Alternative Investments

- These are non-traditional investment types such as real estate investment trusts (REITs), precious metals (gold, silver), and commodities.

- They are often used to diversify portfolios and reduce risk.

A – Account Management

Basics of Managing Savings and Checking Accounts

Effective management of savings and checking accounts is fundamental for financial stability and achieving long-term financial goals. Understanding how these accounts function, how to maintain them, and how to leverage them is essential.

i. Savings Accounts

- Purpose: Used to set aside funds for future use, emergencies, or specific financial goals.

- Interest Rates: Vary depending on the bank and the type of savings account. High-yield savings accounts or certificates of deposit (CDs) offer better interest rates but may have restrictions.

- Automated Savings: Tools like automatic transfers help in consistently building savings over time without needing manual intervention.

ii. Checking Accounts/ Current Accounts

- Purpose: Primarily used for day-to-day financial transactions, such as bill payments, direct deposits, and withdrawals.

- Features: Often include features such as overdraft protection, linked debit cards, and mobile banking.

- Fees: Monthly maintenance fees and other charges may apply depending on the bank’s policies, which can impact overall financial health.

iii. Managing Multiple Accounts

- Diversification: Having multiple accounts for different purposes (e.g., personal, business, emergency) provides better financial control and organization.

- Online Banking: Enhances accessibility and allows for easy monitoring of account balances and transactions.

iv. Account Security

- Protecting personal and financial information through secure login practices and fraud monitoring services is crucial for preventing identity theft and unauthorized access to accounts.

B – Budgeting

Importance of Creating and Maintaining a Budget

Budgeting is a fundamental skill for managing personal finances effectively. It helps individuals allocate resources, track expenses, and set financial goals, ensuring financial stability and preparedness for future financial challenges.

i. Purpose of Budgeting

- Financial Control: Provides a clear picture of income versus expenses, helping to avoid debt and ensure savings are directed toward meaningful goals.

- Goal Setting: Allows for short-term and long-term financial objectives, such as saving for a home, retirement, or education.

ii. Creating a Budget

Step-by-Step Process:

- Income Assessment: Document all sources of income, including salary, freelance work, investments, or other revenue streams.

- Expense Tracking: Categorize expenses into fixed (rent, utilities), variable (entertainment, groceries), and discretionary (luxuries) spending.

- Savings Allocation: Allocate a portion of income toward savings or emergency funds to build financial resilience.

iii. Tools and Methods

- Spreadsheets: Excel or Google Sheets can be used to track income and expenses effectively.

- Budgeting Apps: Tools like Mint, YNAB, or PocketGuard simplify budgeting and provide real-time insights into financial health.

- Envelope System: A physical cash system where cash is allocated for specific spending categories to avoid overspending.

iv. Challenges and Solutions

- Overspending: Adjusting budgets regularly and setting realistic limits.

- Unexpected Expenses: Building flexibility in the budget with a contingency fund for emergencies.

B – Borrowing

Different Types of Loans

Borrowing is a necessary aspect of personal finance for many individuals to fund major expenses such as education, purchasing a home, or starting a business. Understanding the various types of loans, terms, and repayment strategies is essential.

i. Student Loans

Purpose: Financing higher education costs (tuition, books, living expenses).

Types:

- Federal Student Loans: Offered by the government with lower interest rates and flexible repayment options.

- Private Student Loans: Provided by banks or private lenders, generally with higher interest rates and stricter repayment terms.

ii. Mortgages

Purpose: Used to purchase real estate.

Types:

- Fixed-Rate Mortgages: Interest rate remains the same throughout the loan term.

- Adjustable-Rate Mortgages (ARMs): Interest rates fluctuate periodically based on market conditions.

Repayment: Monthly payments cover principal and interest, with options for longer terms (e.g., 15, 30 years).

iii. Personal Loans

Purpose: Used for debt consolidation, home improvement, or emergency funds.

Interest Rates: Vary based on credit score and loan terms, often shorter than mortgages or student loans.

Unsecured vs. Secured:

- Unsecured Loans: No collateral required but typically come with higher interest rates.

- Secured Loans: Requires collateral (e.g., car loan, home equity loan), providing lower interest rates.

iv. Credit Cards

- Revolving Credit: Allows individuals to borrow funds up to a credit limit and repay the borrowed amount over time.

- Interest Rates: Varies based on credit score, with higher rates for individuals with poor credit.

- Benefits: Provides flexibility in managing cash flow and earning rewards (e.g., cashback, points).

v. Debt Consolidation Loans

- Combines multiple existing debts into a single loan with potentially lower interest rates for easier management and repayment.

C – Credit

How Credit Scores Are Calculated and Improving Credit

Credit plays a critical role in personal finance, affecting loan approvals, interest rates, and financial health. A good credit score indicates creditworthiness and helps in accessing better financial opportunities.

i. Components of a Credit Score

- Payment History: The most significant factor (35%), reflecting whether payments are made on time.

- Credit Utilization: Accounts for 30% of the score, which is the ratio of credit used versus credit available.

- Credit Length: Duration of credit accounts, contributing 15% to the score.

- Credit Mix: Diversity of credit types, making up 10%.

- New Credit Applications: Accounts for 10%, evaluating recent inquiries and accounts opened.

ii. Improving Credit

- Paying Bills on Time: Consistently making payments improves credit score significantly.

- Reducing Debt: Lowering credit card balances and overall debt-to-income ratio enhances creditworthiness.

- Avoiding New Credit: Limiting new applications and inquiries can prevent negative impacts on credit scores.

- Building Credit History: Responsible use of secured credit cards and timely repayments can establish a positive credit history.

iii. Impact of Poor Credit

- Higher Interest Rates: Poor credit can lead to higher loan and credit card interest rates.

- Denials: Lenders may deny loans or offer less favorable terms to individuals with low credit scores.

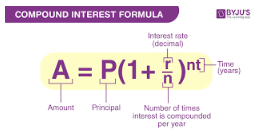

C – Compound Interest

Concept and Benefits of Compounding Over Time

Compound interest is one of the most powerful tools for wealth accumulation in personal finance. It refers to earning interest not only on the initial principal but also on the accumulated interest over time.

i. Understanding Compound Interest

Formula: A = P(1 + r/n)^(nt), where:

- A = the future value of the investment/loan

- P = principal (initial amount)

- r = annual interest rate (as a decimal)

- n = number of times interest is compounded per year

- t = number of years the money is invested or borrowed

ii. Benefits

- Wealth Accumulation: Over time, compound interest can turn small initial investments into significant wealth.

- Financial Growth: Allows individuals to benefit from exponential growth, especially in long-term investments like retirement accounts.

- Minimizing Debt: In terms of loans, compounding interest increases the debt burden, emphasizing the importance of early repayment.

iii. Maximizing Compounding

- Long-Term Investments: Compounding works best over extended periods, such as retirement accounts (401(k), IRAs).

- Reinvestment: Reinvesting earned interest ensures that the compounding effect continues to grow over time.

C – Cash Flow

Tracking Income vs. Expenses

Cash flow management is crucial for financial stability and wealth-building. Understanding where money comes from and how it is spent enables individuals to prioritize saving and investment strategies effectively.

i. Components of Cash Flow

- Income: Earned income from employment, business, or other sources like royalties and dividends.

- Expenses: Fixed, variable, and discretionary expenses.

ii. Analyzing Cash Flow

- Positive Cash Flow: When income exceeds expenses, allowing for savings and investments.

- Negative Cash Flow: Occurs when expenses surpass income, often requiring borrowing or liquidation of assets to cover the gap.

iii. Creating a Cash Flow Statement

- Income: Include all forms of revenue (wages, rental income, side hustles).

- Expenses: Categorize into essentials (housing, transportation), discretionary (entertainment, dining), and savings.

- Savings: Allocate funds toward emergency savings, retirement, and other financial goals to ensure sustainable cash flow management.

iv. Improving Cash Flow

- Increasing Income: Pursuing side hustles, investing in education, or developing new skills to boost earning potential.

- Reducing Expenses: Identifying and cutting unnecessary spending, optimizing utility bills, or seeking cost-effective alternatives.

- Automating Savings: Setting up automatic transfers to ensure consistent contributions to savings accounts or investment vehicles.

D – Debt Management: Strategies to Manage and Reduce Debt

Debt management is a crucial component of personal finance, as effectively handling and reducing debt can significantly improve financial health and stability. Managing debt involves understanding various types of debt, their implications, and implementing strategies to either minimize them or prevent accumulation.

Types of Debt

- Consumer Debt: This includes credit card debt, personal loans, and store credit. Typically short-term, these loans often come with high-interest rates.

- Mortgage Debt: Home loans are generally long-term commitments with lower interest rates compared to other types of debt.

- Student Loan Debt: Education loans, which may be federal or private, often have flexible repayment terms but can accumulate high interest over time.

- Automobile Loans: Secured loans used to purchase vehicles, generally with fixed repayment terms.

Strategies for Managing Debt

- Budgeting: An essential first step in managing debt. Budgeting helps allocate income to necessary expenses while ensuring debt payments are prioritized.

- Debt Snowball: This method focuses on paying off the smallest debt first while maintaining minimum payments on other debts. Once the smallest debt is eliminated, the payments are rolled over to the next smallest debt.

- Debt Avalanche: In this strategy, the individual targets the debt with the highest interest rate first, saving more in interest over time.

- Debt Consolidation: Combining multiple debts into one loan with a lower interest rate to simplify repayment.

- Debt Settlement: Negotiating with creditors to settle debts for less than what is owed, usually requiring lump-sum payments.

Importance of Financial Education in Debt Management

Understanding the nuances of interest rates, repayment terms, and the impact of debt on credit scores is essential for effectively managing and reducing debt. Financial literacy plays a key role in preventing the accumulation of debt by guiding individuals through sound borrowing practices.

D – Diversification: Importance of Spreading Investments Across Different Assets

Diversification is a fundamental investment principle aimed at reducing risk by spreading investments across various asset classes, industries, and geographic regions. It helps manage volatility and ensures that poor performance in one area does not significantly impact overall investment returns.

Importance of Diversification

- Risk Management: Diversification reduces risk by not relying heavily on a single asset class or sector.

- Consistency in Returns: A diversified portfolio smooths out the highs and lows of market fluctuations, resulting in more consistent returns over time.

- Market Cycles: Different asset classes react differently to market cycles—stocks, bonds, real estate, commodities, etc.—allowing diversification to benefit from a well-rounded approach.

Types of Diversification

- Asset Class Diversification: Balancing between equities (stocks), fixed income (bonds), real estate, and cash equivalents.

- Sector Diversification: Investing across various industries such as technology, healthcare, finance, energy, etc.

- Geographic Diversification: Spreading investments across global markets to minimize country-specific risks.

- Style Diversification: Combining different investment strategies, such as growth stocks, value stocks, and small-cap or large-cap stocks.

Tools for Diversification

- Mutual Funds and ETFs (Exchange-Traded Funds): Offer built-in diversification through holding a variety of assets within a single investment.

- Rebalancing: Regularly adjusting the portfolio to maintain desired levels of diversification.

E – Emergency Fund: Importance and How to Build One

An emergency fund is a critical financial safety net designed to cover unexpected expenses such as medical emergencies, job loss, or urgent home repairs. It provides peace of mind by ensuring that financial crises don’t lead to further debt accumulation.

Importance of an Emergency Fund

- Financial Security: Reduces the need to rely on credit cards or loans during financial emergencies.

- Avoidance of Debt: Helps avoid accumulating high-interest debt to meet immediate financial needs.

- Unexpected Life Events: Provides a buffer during unexpected events like medical emergencies, unemployment, or major home repairs.

- Stress Reduction: Having an emergency fund alleviates financial stress, allowing individuals to make informed decisions without panic.

Building an Emergency Fund

Determining the Right Amount: A general guideline is to aim for 3-6 months of living expenses, but this can vary based on personal circumstances, such as dependents, income stability, and lifestyle.

Saving Strategies:

- Set a Goal: Break down the total required into manageable steps, saving consistently over time.

- Automated Savings: Set up automatic transfers from your primary account to a dedicated emergency fund account.

- Increase Contributions: Increase contributions incrementally with salary raises or financial windfalls.

Safe Storage of Funds: Keeping emergency funds in a liquid, accessible account such as a high-yield savings account or money market account ensures quick access during crises.

E – Estate Planning: Basics of Wills, Trusts, and Estate Management

Estate planning is the process of arranging for the transfer of assets after an individual’s death, ensuring that the distribution of wealth aligns with their wishes and minimizes legal complexities and tax burdens.

Components of Estate Planning

- Wills: A legal document that outlines how an individual’s assets will be distributed after death.

- Trusts: A legal arrangement where assets are held by a trustee for the benefit of beneficiaries.

- Power of Attorney: Designating a person to make financial and healthcare decisions on behalf of the individual if they become incapacitated.

- Healthcare Directives: Documents outlining medical treatment preferences in case of a terminal illness or emergency situation.

Importance of Estate Planning

- Asset Protection: Minimizes the risk of disputes among heirs and ensures smooth asset distribution.

- Tax Efficiency: Strategically planned estates can reduce estate taxes and inheritance taxes, preserving wealth for future generations.

- Contingency Planning: Prepares for unforeseen circumstances, ensuring that wishes are met and legal matters are handled efficiently.

Steps to Effective Estate Planning

- Identify Assets: List all financial and non-financial assets.

- Choose an Executor: Appoint a responsible individual to carry out the will’s instructions.

- Update Beneficiaries: Ensure beneficiaries on retirement accounts, insurance policies, and investment accounts are current.

F – Financial Planning: Setting Goals and Creating a Financial Plan

Financial planning is a comprehensive approach to managing personal finances, aligning financial resources with life goals. It involves setting short-term and long-term financial objectives and creating actionable steps to achieve them.

Importance of Financial Planning

- Achieving Financial Goals: Financial planning outlines a roadmap for individuals to achieve both immediate and future financial objectives.

- Budgeting and Forecasting: Helps predict future financial needs and allocate resources efficiently.

- Risk Management: Identifying potential risks and creating strategies to mitigate them ensures financial stability.

Key Components of Financial Planning

- Assessing Current Financial Situation: Gathering information on income, expenses, assets, liabilities, and net worth.

- Setting Financial Goals: Defining both short-term (e.g., saving for a vacation) and long-term goals (e.g., retirement planning).

- Developing a Budget: Crafting a budget that aligns with financial goals while covering essential expenses and debt repayment.

- Investment Planning: Allocating resources towards various investment opportunities aligned with risk tolerance and financial objectives.

F – Financial Literacy: Understanding Financial Terms and Concepts

Financial literacy is the ability to understand and effectively manage various financial aspects of life, including budgeting, investing, debt management, and financial decision-making.

Importance of Financial Literacy

- Informed Decision-Making: Empowering individuals to make sound financial decisions that align with their goals.

- Long-Term Financial Success: Reduces the likelihood of financial mistakes, such as poor investments or excessive debt.

- Adaptability: Equips individuals to navigate changing financial environments, such as inflation, market volatility, or economic downturns.

Key Areas of Financial Literacy

- Savings and Investment: Understanding different savings vehicles (e.g., retirement accounts, 529 plans) and investment options.

- Debt and Credit Management: Knowledge of how credit scores are calculated and strategies for maintaining healthy debt-to-income ratios.

- Insurance: Understanding various types of insurance, including health, life, auto, and property.

- Taxation: Basics of income tax, deductions, credits, and filing strategies to minimize liabilities.

G – Goals: Setting Short-term and Long-term Financial Goals

Setting financial goals is an essential part of personal finance. These goals provide direction, purpose, and a measurable framework for financial planning. Short-term and long-term goals help individuals manage their financial resources efficiently, ensuring both immediate and future needs are addressed.

Importance of Financial Goals

- Clarity and Focus: Goals give individuals a clear understanding of what they are working towards, which leads to more focused financial decision-making.

- Motivation: Having defined financial goals creates a sense of purpose and motivation, driving consistent efforts to achieve them.

- Budgeting and Savings: Helps in creating realistic budgets and savings strategies aligned with goals, ensuring sustainable financial health.

Setting Short-term Financial Goals

Short-term goals typically span from a few weeks to a few years, covering immediate financial needs or upcoming expenses.

- Emergency Fund: Building an emergency fund for unexpected expenses such as medical emergencies, vehicle repairs, or urgent home fixes.

- Debt Repayment: Establishing a timeline for paying off credit card debt, student loans, or personal loans within 1-3 years.

- Education: Saving for educational expenses, such as tuition, books, and living expenses for higher education or professional certifications.

- Vacation or Personal Purchases: Funding travel, weddings, or large personal expenses like home improvements or vehicle upgrades within a defined timeframe.

Strategies for Achieving Short-term Goals

- Set Realistic Timelines: Break down short-term goals into monthly or quarterly objectives.

- Monitor Progress: Regularly track progress to ensure timely accomplishment of these goals.

- Automated Savings: Use automated transfers to designated accounts for specific short-term objectives, making consistent contributions easier.

Setting Long-term Financial Goals

Long-term financial goals often span five years or more, addressing major life milestones such as retirement, homeownership, or wealth accumulation.

- Retirement Planning: Estimating future retirement needs and saving consistently to reach financial independence.

- Wealth Accumulation: Building investment portfolios aimed at achieving significant wealth accumulation over decades.

- Homeownership: Planning to buy a home and managing costs related to property, renovations, and ongoing maintenance.

- Estate Planning: Creating a legacy by ensuring assets are passed on according to wishes, including wills, trusts, and philanthropic goals.

Importance of Breaking Down Long-term Goals

Long-term goals require careful planning and patience, and breaking them down into achievable milestones enhances success. Regularly reviewing these goals ensures that financial strategies remain aligned with personal circumstances and market conditions.

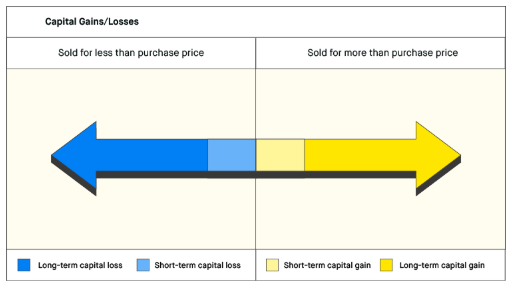

G – Gains and Losses: Managing Investment Gains and Losses

Investing carries inherent risks, with the potential for significant gains and losses depending on market fluctuations and personal strategies. Effectively managing these fluctuations is crucial to achieving long-term investment success.

Understanding Investment Gains and Losses

- Capital Gains: Profits earned from selling assets like stocks, bonds, or real estate for more than the purchase price.

- Capital Losses: Losses incurred when assets are sold for less than their purchase price, which can offset taxable gains.

Strategies for Managing Gains

- Tax-Loss Harvesting: Selling underperforming investments to offset gains and reduce tax liability.

- Asset Rebalancing: Adjusting portfolio allocations to maintain a balanced mix of high-performing assets while moderating risks.

Strategies for Managing Losses

- Diversification: Spreading investments across different asset classes to minimize the impact of poor-performing assets on overall returns.

- Risk Management: Setting predetermined loss limits and adjusting portfolio allocations to avoid excessive exposure to volatile assets.

H – Insurance: Types of Insurance (Health, Life, Property) and Its Importance

Insurance is a critical financial tool designed to provide protection against unforeseen risks and liabilities. It provides a safety net, ensuring financial security in various aspects of life, including health, life, and property.

Types of Insurance and Their Importance

i. Health Insurance: Covers medical expenses, including doctor visits, hospital stays, prescription medications, and preventive care.

- Importance: Reduces out-of-pocket costs for medical services and protects against high medical expenses.

- Employer vs. Private Plans: Depending on employment status, health insurance can be employer-provided or purchased individually through private insurers.

ii. Life Insurance: Provides financial protection for dependents and beneficiaries upon the policyholder’s death, offering a lump sum or ongoing income.

- Importance: Secures financial stability for loved ones, covering expenses like mortgages, education, and daily living costs.

- Types: Term life insurance (temporary coverage for a specific period) and whole life insurance (provides lifelong protection and includes an investment component).

iii. Property Insurance: Protects assets such as homes, vehicles, and business property from damages, theft, or natural disasters.

- Importance: Safeguards against financial loss due to unexpected property damage or theft, ensuring replacement or repair coverage.

H – Homeownership: Financial Aspects of Purchasing and Maintaining a Home

Owning a home is a significant financial milestone that involves a comprehensive understanding of costs, financing, and long-term maintenance. From mortgage financing to home upkeep, homeownership offers both rewards and challenges.

Steps to Purchasing a Home

- Financial Assessment: Evaluate income, debts, and credit history to determine affordability and obtain mortgage pre-approval.

- Down Payment: Typically, a down payment of 5-20% of the home’s value is required, impacting monthly mortgage payments and interest rates.

- Mortgage Options: Fixed-rate mortgages provide consistent monthly payments, while adjustable-rate mortgages offer lower initial payments with potential adjustments over time.

- Closing Costs and Additional Expenses: Include legal fees, inspection costs, property taxes, and homeowners insurance.

Ongoing Costs of Homeownership

- Maintenance and Repairs: Regular upkeep of the property to prevent costly damages, including landscaping, HVAC servicing, plumbing, and roof repairs.

- Utilities and Property Taxes: Ongoing monthly expenses like electricity, water, sewer, and property taxes contribute to the overall cost of homeownership.

I – Investment Basics: Introduction to Stocks, Bonds, Mutual Funds

Investments form the backbone of wealth-building and long-term financial growth. Understanding the fundamentals of stocks, bonds, and mutual funds enables individuals to construct diversified portfolios that align with their financial goals.

Stocks

- Equity Investments: Ownership in a company, offering potential capital appreciation and dividend payouts.

- Risk vs. Return: Stocks provide higher returns over time, but also carry higher risk compared to fixed-income assets like bonds.

Bonds

- Fixed-Income Investments: Loans made to corporations or governments, offering predictable interest payments and return of principal at maturity.

- Types of Bonds: Includes government bonds (e.g., Treasury), municipal bonds, corporate bonds, and zero-coupon bonds.

Mutual Funds

- Diversified Investment: Pools money from multiple investors to invest in a variety of stocks, bonds, or other securities.

- Professional Management: Managed by fund managers who allocate assets based on the fund’s strategy, reducing the need for individual stock-picking.

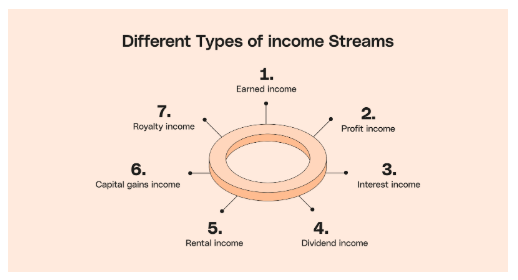

I – Income Streams: Identifying Different Sources of Income

Income streams provide a foundation for financial stability and growth. Diversifying income sources ensures that financial well-being is not solely reliant on a single source of earnings.

Types of Income Streams

- Active Income: Earned from employment, freelance work, or business ventures where direct effort and time contribute to earnings.

- Passive Income: Generated through investments, real estate, royalties, or other sources that require minimal ongoing effort.

- Residual Income: Earnings from work completed in the past, such as royalties from music, patents, or stock dividends.

J – Joint Finances: Managing Finances with a Partner or Spouse

Managing joint finances involves balancing individual and shared financial goals with a partner or spouse, ensuring that financial decisions are transparent and equitable.

Challenges of Joint Finances

- Communication: Open discussions about financial expectations, responsibilities, and long-term goals are essential.

- Budgeting: Joint budgets require balancing individual needs with shared expenses such as housing, education, and savings.

Strategies for Successful Joint Finances

- Joint vs. Separate Accounts: Combining some accounts for shared expenses while maintaining separate accounts for personal spending ensures flexibility.

- Shared Goals: Setting mutual financial goals, such as homeownership or retirement planning, provides a unified path toward financial success.

J – Job Benefits: Understanding Employee Benefits (e.g., Retirement Plans, Health Insurance)

Job benefits enhance financial stability by offering additional resources for retirement savings, healthcare, and other essential areas of personal finance.

Common Employee Benefits

- Retirement Plans: Employer-sponsored retirement accounts such as 401(k)s, offering employer matching contributions and tax advantages.

- Health Insurance: Comprehensive coverage typically includes medical, dental, and vision care, reducing out-of-pocket healthcare expenses.

- Paid Time Off (PTO): Includes vacation, sick leave, and personal days, contributing to overall financial and mental well-being.

Conclusion

The ABC’s of personal finance offer a comprehensive guide to understanding and managing key financial concepts essential for achieving long-term financial stability and success. From setting and achieving financial goals to managing investments, debt, and insurance, each subtopic plays a crucial role in shaping a well-rounded financial strategy.

Through effective management of assets, creating a diversified investment portfolio, and understanding financial instruments such as stocks, bonds, and mutual funds, individuals can build wealth while mitigating risks. Additionally, planning for both short-term and long-term financial objectives ensures that personal finances are aligned with life aspirations, whether it’s homeownership, retirement, or estate planning.

Effective financial management also involves maintaining a healthy balance between income streams, controlling debt, and making informed decisions about borrowing, budgeting, and saving. By understanding the intricacies of credit scores, compound interest, and cash flow management, individuals can make more strategic financial decisions, ensuring financial well-being in both the short and long term.

Furthermore, managing joint finances, navigating job benefits, and securing the right insurance coverage add layers of security and stability to personal finance management. Whether it’s through active income, passive streams, or residual earnings, diversified income sources strengthen financial resilience.

Ultimately, the ABC’s of personal finance provide a foundation for sound financial planning, empowering individuals to take control of their financial future and navigate life’s financial

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.